Question: please answer 1-6 showing all work 1. The Jonus-Timberland Wardrobe Co. just paid a dividend of $2.15 per share on its stock. The dividends are

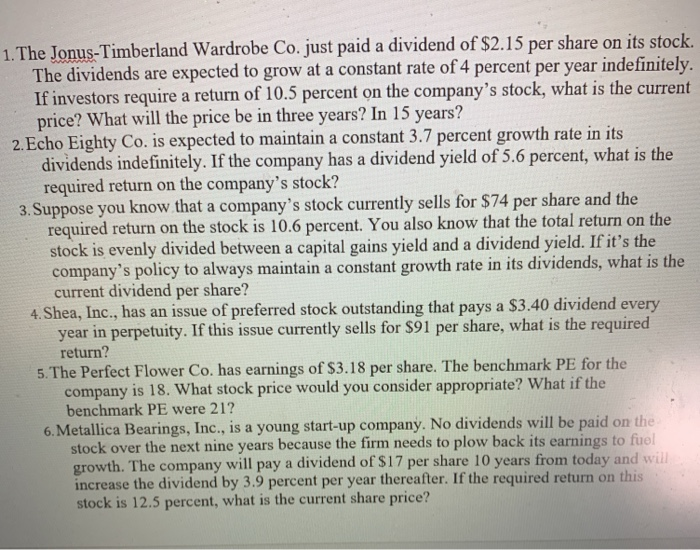

1. The Jonus-Timberland Wardrobe Co. just paid a dividend of $2.15 per share on its stock. The dividends are expected to grow at a constant rate of 4 percent per year indefinitely. If investors require a return of 10.5 percent on the company's stock, what is the current price? What will the price be in three years? In 15 years? 2. Echo Eighty Co. is expected to maintain a constant 3.7 percent growth rate in its dividends indefinitely. If the company has a dividend yield of 5.6 percent, what is the required return on the company's stock? 3. Suppose you know that a company's stock currently sells for $74 per share and the required return on the stock is 10.6 percent. You also know that the total return on the stock is evenly divided between a capital gains yield and a dividend yield. If it's the company's policy to always maintain a constant growth rate in its dividends, what is the current dividend per share? 4. Shea, Inc., has an issue of preferred stock outstanding that pays a $3.40 dividend every year in perpetuity. If this issue currently sells for $91 per share, what is the required return? 5. The Perfect Flower Co. has earnings of $3.18 per share. The benchmark PE for the company is 18. What stock price would you consider appropriate? What if the benchmark PE were 21? 6. Metallica Bearings, Inc., is a young start-up company. No dividends will be paid on the stock over the next nine years because the firm needs to plow back its earnings to fuel growth. The company will pay a dividend of $17 per share 10 years from today and will increase the dividend by 3.9 percent per year thereafter. If the required return on this stock is 12.5 percent, what is the current share price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts