Question: Answer without using excel and minimize shortcuts including the use if a financial calculator. Please show all work Q1) The Stopperside Wardrobe Co. just paid

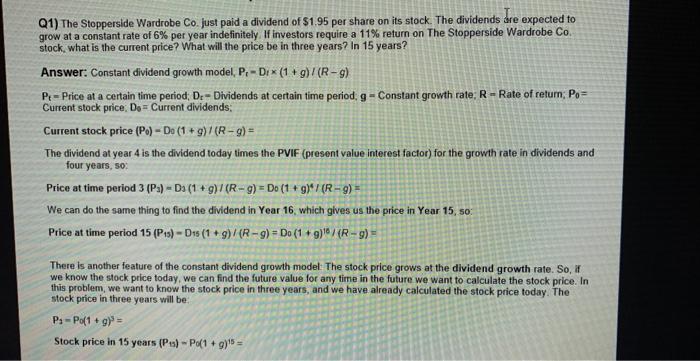

Q1) The Stopperside Wardrobe Co. just paid a dividend of $1.95 per share on its stock. The dividends are expected to grow at a constant rate of 6% per year indefinitely. If investors require a 11% return on The Stopperside Wardrobe Co. stock, what is the current price? What will the price be in three years? In 15 years? Answer: Constant dividend growth model, Pt=Di(1+g)/(Rg) Pt= Price at a certain time period; Dt= Dividends at certain time period; g= Constant growth rate; R=Rate of return; P0= Current stock price; De = Current dividends; Current stock price (P0)=Do0(1+g)/(Rg)= The dividend at year 4 is the dividend today times the PVIF (present value interest factor) for the growth rate in dividends and four years, so: Price at time period 3(P3)=D3(1+g)/(Rg)=D0(1+g)4/(Rg)= We can do the same thing to find the dividend in Year 16, which gives us the price in Year 15, 50: Price at time period 15(P15)=D15(1+g)/(Rg)=D0(1+g)18/(Rg)= There is another feature of the constant dividend growth model: The stock price grows at the dividend growth rate. So, if we know the stock price today, we can find the future value for any time in the future we want to calculate the stock price. In this problem, we want to know the stock price in three years, and we have already calculated the stock price today. The stock price in three years will be. P2=P0(1+g)3= Stock price in 15 years (P13)=P0(1+g)15=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts