Question: please answer 1-7 Draw Design Layout ACCT 201 - Second Homework Assignment - $22. Compatibility Mode Mailings Review View Tell me References Calibri (Bo... 14

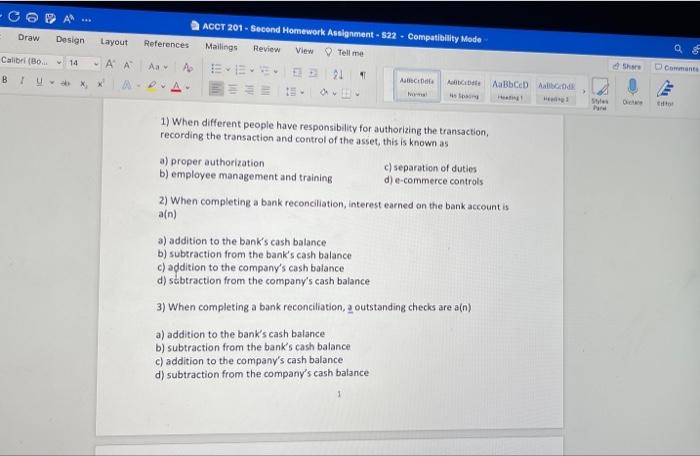

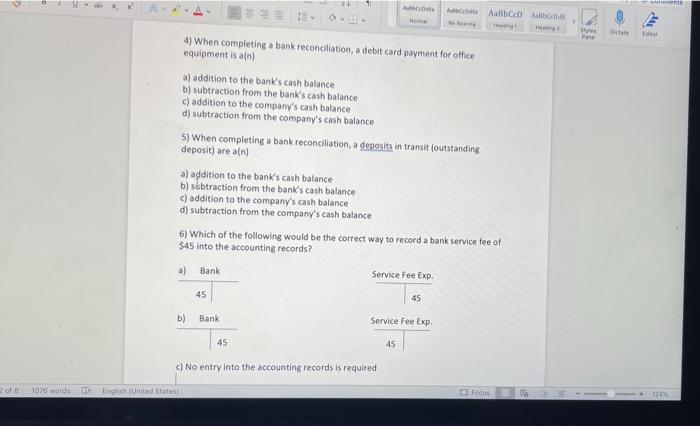

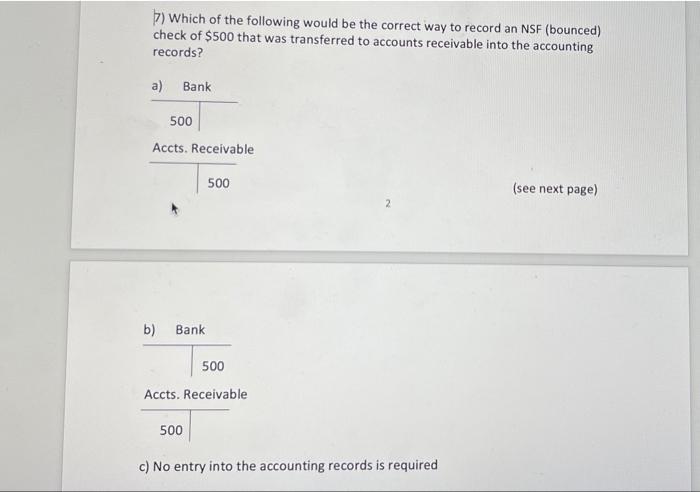

Draw Design Layout ACCT 201 - Second Homework Assignment - $22. Compatibility Mode Mailings Review View Tell me References Calibri (Bo... 14 Share Comments - A A A A EEE ADA 21 B : u X Acte e ABCD A Styles 1) When different people have responsibility for authorizing the transaction, recording the transaction and control of the asset, this is known as a) proper authorization c) separation of duties b) employee management and training d) e-commerce controls 2) When completing a bank reconciliation, interest earned on the bank account is ain) a) addition to the bank's cash balance b) subtraction from the bank's cash balance c) addition to the company's cash balance d) sabtraction from the company's cash balance 3) When completing a bank reconciliation, a outstanding checks are a(n) a) addition to the bank's cash balance b) subtraction from the bank's cash balance c) addition to the company's cash balance d) subtraction from the company's cash balance AD ABCD he Bytes Pan 4) When completing a bank reconciliation, a debit card payment for office equipment is an a) addition to the bank's cash balance b) subtraction from the bank's cash balance c) addition to the company's cash balance d) subtraction from the company's cash balance 5) When completing a bank reconciliation, a deposits in transit (outstanding deposit) are an) a) addition to the bank's cash balance b) sebtraction from the bank's cash balance c) addition to the company's cash balance d) subtraction from the company's cash balance 6) Which of the following would be the correct way to record a bank service fee of $45 into the accounting records? a) Bank Service Fee Exp. 45 45 b) Bank Service Fee Exp 45 45 c) No entry into the accounting records is required 1076 words Toshnited States 124 5) Which of the following would be the correct way to record an NSF (bounced) check of $500 that was transferred to accounts receivable into the accounting records? a) Bank 500 Accts. Receivable 500 (see next page) 2 b) Bank 500 Accts. Receivable 500 c) No entry into the accounting records is required

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts