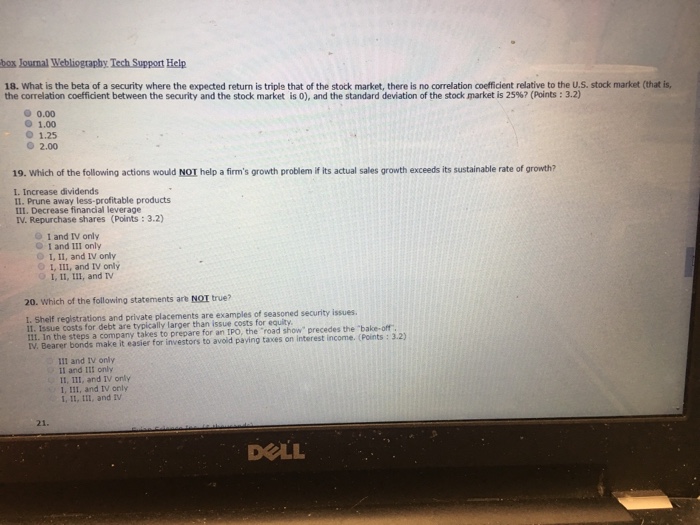

Question: Please answer 18,19,20 box Journal Webliogtaphy. Tech Support Help 18. What is the beta of a security where the expected return is triple that of

box Journal Webliogtaphy. Tech Support Help 18. What is the beta of a security where the expected return is triple that of the stock market, there is no correllation coefficient relative to the U.S. stock market (that is, the correlation coefficient between the security and the stock market is 0), and the standard deviation of the stock market is 25%? (Points : 32) 0.00 O 1.00 . ? 1.25 2.00 19. which of the following actions would NOT help a firm's growth problem ifits actual sales growth exceeds its sustainable rate of growth? I. Increase dividends Il. Prune away less-profitable products IV. Repurchase shares (Points: 3.2) III. Decrease finandial leverage I and IV only 0 I and III only O I, II, and IV only O t, III, and IV only I, I1, 111, and IV 20. Which of the following statements are NOI true? t. Sheilf reoistrations and private placements are examples of seasoned security issues. 11. Issue costs for debt are typically larger than issue costs for equity I!l. In the steps a company takes to prepare for an IPO, the road show precedes the "bake-off 1. Bearer bonds make it easier for investors to avoid paying tares on interest income, Ports III and IV only II and III only II, III, and IV only I, 11I, and IV only I, I1, i11, and IV 21 DOLL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts