Question: please answer 19 and 20 19) Assume a project will increase inventory by $61,000, accounts payable by $28,000, and accounts receivable by $36,000. What is

please answer 19 and 20

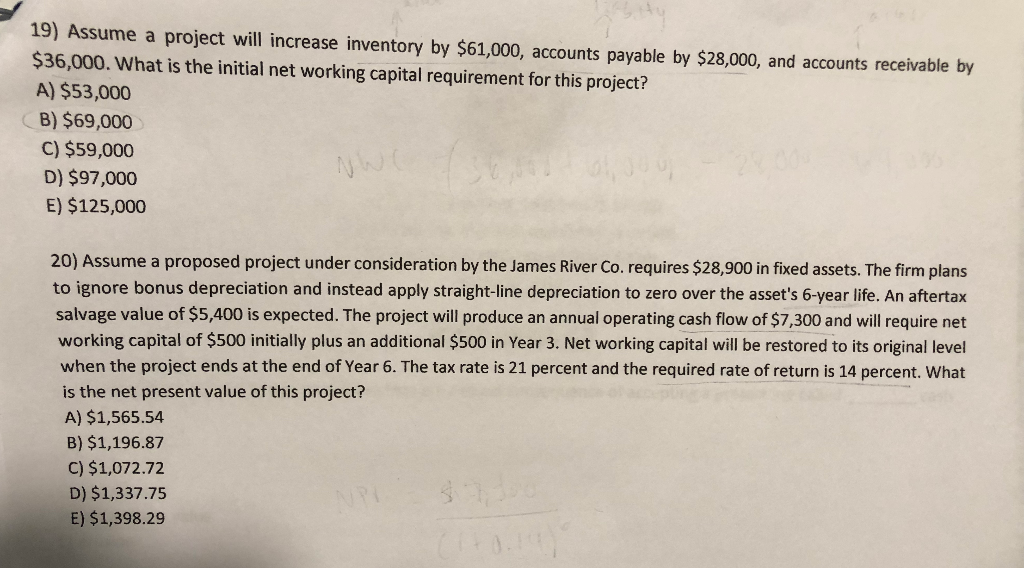

19) Assume a project will increase inventory by $61,000, accounts payable by $28,000, and accounts receivable by $36,000. What is the initial net working capital requirement for this project? A) $53,000 B) $69,000 C) $59,000 D) $97,000 E) $125,000 20) Assume a proposed project under consideration by the James River Co. requires $28,900 in fixed assets. The firm plans to ignore bonus depreciation and instead apply straight-line depreciation to zero over the asset's 6-year life. An aftertax salvage value of $5,400 is expected. The project will produce an annual operating cash flow of $7,300 and will require net working capital of $500 initially plus an additional $500 in Year 3. Net working capital will be restored to its original level when the project ends at the end of Year 6. The tax rate is 21 percent and the required rate of return is 14 percent. What is the net present value of this project? A) $1,565.54 B) $1,196.87 C) $1,072.72 D) $1,337.75 E) $1,398.29

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts