Question: please answer 1-9 thank you! i will give thumbs up for all answers. 1. Cash held represents the major portion of a bank's required reserves.

please answer 1-9 thank you! i will give thumbs up for all answers.

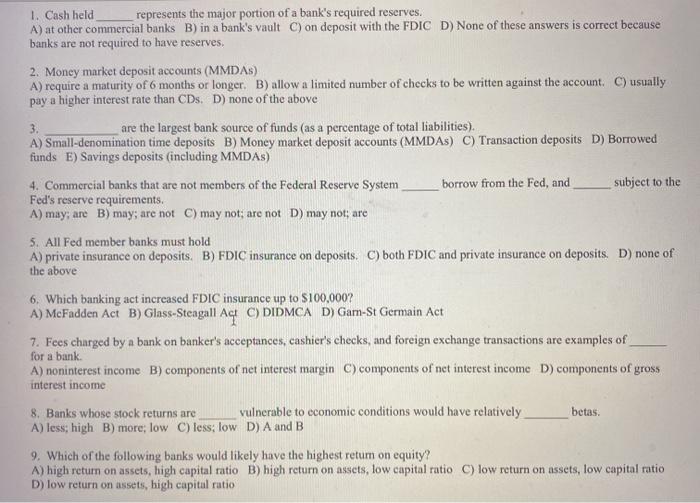

please answer 1-9 thank you! i will give thumbs up for all answers. 1. Cash held represents the major portion of a bank's required reserves. A) at other commercial banks B) in a bank's vault C) on deposit with the FDIC D) None of these answers is correct because banks are not required to have reserves 2. Money market deposit accounts (MMDAS) A) require a maturity of 6 months or longer. B) allow a limited number of checks to be written against the account. C) usually pay a higher interest rate than CDs, D) none of the above 3. are the largest bank source of funds (as a percentage of total liabilities). A) Small-denomination time deposits B) Money market deposit accounts (MMDA) C) Transaction deposits D) Borrowed funds E) Savings deposits (including MMDAs) 4. Commercial banks that are not members of the Federal Reserve System borrow from the Fed, and subject to the Fed's reserve requirements. A) may, are B) may, are not C) may not: are not D) may not: are 5. All Fed member banks must hold A) private insurance on deposits. B) FDIC insurance on deposits. C) both FDIC and private insurance on deposits. D) none of the above 6. Which banking act increased FDIC insurance up to $100,000? A) McFadden Act B) Glass-Steagall Aq C) DIDMCA D) Garn-St Germain Act 7. Fees charged by a bank on banker's acceptances, cashier's checks, and foreign exchange transactions are examples of for a bank A) noninterest income B) components of net interest margin C) components of net interest income D) components of gross interest income 8. Banks whose stock returns are vulnerable to economic conditions would have relatively betas. A) less, high B) more, low c) less; low D) A and B 9. Which of the following banks would likely have the highest retum on equity? A) high return on assets, high capital ratio B) high return on assets, low capital ratio C) low return on assets, low capital ratio D) low return on assets, high capital ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts