Question: Please answer 23 & 24 23. Continued from Question 22, does the cover interest abitrage work for you as a U.S. investor? And does Interest

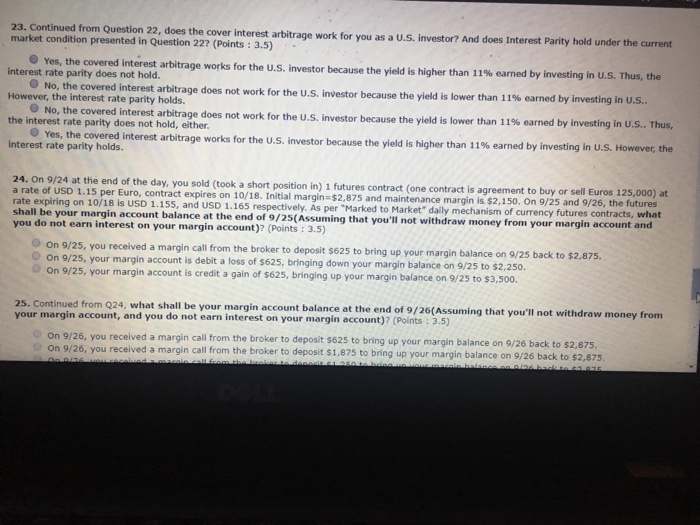

23. Continued from Question 22, does the cover interest abitrage work for you as a U.S. investor? And does Interest Parity hold under the current market condition presented in Question 22? (Points : 3.5) O Yes, the covered interest arbitrage works for the US. investor because the yield is higher than 11% earned by investing in us. Thus, the interest rate parity does not hold. O No, the covered interest arbitrage does not work for the However, the interest rate parity holds. investor because the yield is lower than 11% earned by investing in US O No, the covered interest arbitrage does not work for the U.S. investor because the yield is lower than 11% earned by i nvesting in us.. Thus, the interest rate parity does not hold, either Yes, the covered interest arbitrage works for the us. investor because the yield is higher than 11% earned by investing i US However, the interest rate parity holds 24. On 9/24 at the end of the day, you sold (took a short position in) 1 futu rate expiring on 10/18 is USD 1.155, shall be your margin account balance at the end of o/25(Assuming that you'l not withdraw money from your margin account and res contract (one contract is agreement to buy or sell per uro, contract expires on 10/18. Initial margin $2,875 and maintenance margin uros 125,000) at nism of currency futures contracts, what at argin is $2,150. On 9/25 and 9/26, the futures and USD 1.165 respectively. As per "Marked to Market" daily mecha g that you'll not withdraw money from your margin account and you do not earn interest on your margin account)? (Points : 3.5) O on 9/25, you received a margin call from the broker to deposit s625 to bring up your margin balance on 9/25 back to s O on 9/25, your margin account is debit a loss of $625, bringing down your margin balance on 9/25 OOn 9/25, your margin account is credit a gain of $625, bringing up your margin balance on 9/25 to $3,500. 25. Continued from Q24, what shall be your margin account balance at the end of 9/26(Assuming that you'll not withdraw money from your margin account, and you do not earn interest on your margin account)? (Points : 3.5) On 9/26, you received a margin call from the broker to deposit $625 to bring up your margin balance On 9/26, you received a margin call from the broker to deposit s1,875 to bring up your margin balance on 9/26 back to $2,875 on 9/26 back to $2,875 23. Continued from Question 22, does the cover interest abitrage work for you as a U.S. investor? And does Interest Parity hold under the current market condition presented in Question 22? (Points : 3.5) O Yes, the covered interest arbitrage works for the US. investor because the yield is higher than 11% earned by investing in us. Thus, the interest rate parity does not hold. O No, the covered interest arbitrage does not work for the However, the interest rate parity holds. investor because the yield is lower than 11% earned by investing in US O No, the covered interest arbitrage does not work for the U.S. investor because the yield is lower than 11% earned by i nvesting in us.. Thus, the interest rate parity does not hold, either Yes, the covered interest arbitrage works for the us. investor because the yield is higher than 11% earned by investing i US However, the interest rate parity holds 24. On 9/24 at the end of the day, you sold (took a short position in) 1 futu rate expiring on 10/18 is USD 1.155, shall be your margin account balance at the end of o/25(Assuming that you'l not withdraw money from your margin account and res contract (one contract is agreement to buy or sell per uro, contract expires on 10/18. Initial margin $2,875 and maintenance margin uros 125,000) at nism of currency futures contracts, what at argin is $2,150. On 9/25 and 9/26, the futures and USD 1.165 respectively. As per "Marked to Market" daily mecha g that you'll not withdraw money from your margin account and you do not earn interest on your margin account)? (Points : 3.5) O on 9/25, you received a margin call from the broker to deposit s625 to bring up your margin balance on 9/25 back to s O on 9/25, your margin account is debit a loss of $625, bringing down your margin balance on 9/25 OOn 9/25, your margin account is credit a gain of $625, bringing up your margin balance on 9/25 to $3,500. 25. Continued from Q24, what shall be your margin account balance at the end of 9/26(Assuming that you'll not withdraw money from your margin account, and you do not earn interest on your margin account)? (Points : 3.5) On 9/26, you received a margin call from the broker to deposit $625 to bring up your margin balance On 9/26, you received a margin call from the broker to deposit s1,875 to bring up your margin balance on 9/26 back to $2,875 on 9/26 back to $2,875

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts