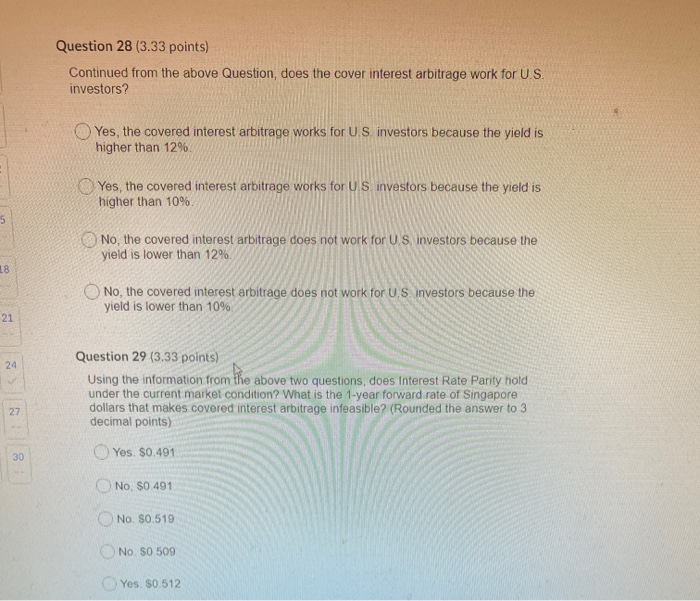

Question: Question 28 (3.33 points) Continued from the above Question, does the cover interest arbitrage work for U.S. investors? Yes, the covered interest arbitrage works for

Question 28 (3.33 points) Continued from the above Question, does the cover interest arbitrage work for U.S. investors? Yes, the covered interest arbitrage works for U.S. investors because the yield is higher than 12% Yes, the covered interest arbitrage works for U.S. investors because the yield is higher than 10% No, the covered interest arbitrage does not work for US investors because the yield is lower than 12% No, the covered interest arbitrage does not work for U.S. Investors because the yield is lower than 10% Question 29 (3.33 points) Using the information from the above two questions, does Interest Rate Parity hold under the current market condition? What is the 1-year forward rate of Singapore dollars that makes covered interest arbitrage infeasible? (Rounded the answer to 3 decimal points) Yes. $0.491 No, 50 491 No. 50.519 No. 50 509 Yes. $0.512 Question 28 (3.33 points) Continued from the above Question, does the cover interest arbitrage work for U.S. investors? Yes, the covered interest arbitrage works for U.S. investors because the yield is higher than 12% Yes, the covered interest arbitrage works for U.S. investors because the yield is higher than 10% No, the covered interest arbitrage does not work for US investors because the yield is lower than 12% No, the covered interest arbitrage does not work for U.S. Investors because the yield is lower than 10% Question 29 (3.33 points) Using the information from the above two questions, does Interest Rate Parity hold under the current market condition? What is the 1-year forward rate of Singapore dollars that makes covered interest arbitrage infeasible? (Rounded the answer to 3 decimal points) Yes. $0.491 No, 50 491 No. 50.519 No. 50 509 Yes. $0.512

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts