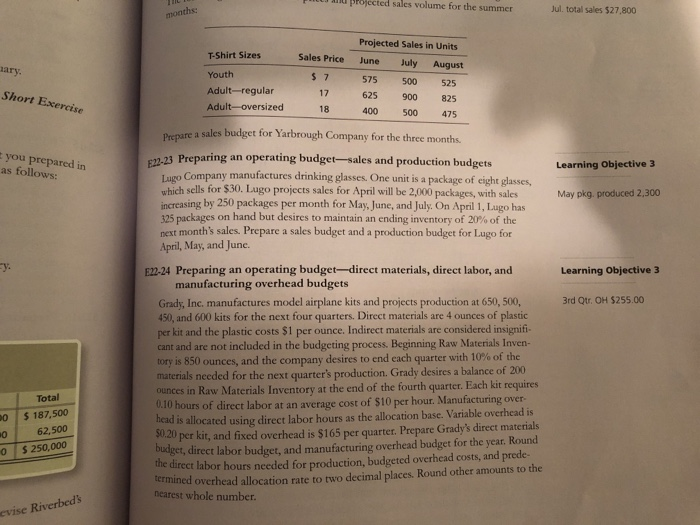

Question: please answer 25 projected sales volume for the summer Jul. total sales $27,800 months Projected Sales in Units T-Shirt Sizes Youth Adult-regular Adult-oversized Sales Price

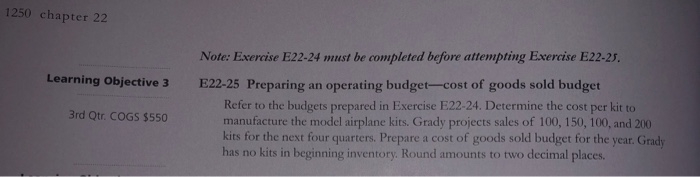

projected sales volume for the summer Jul. total sales $27,800 months Projected Sales in Units T-Shirt Sizes Youth Adult-regular Adult-oversized Sales Price June July August ary $7575 500 525 17 625 900 825 400 500 475 a sales budget for Yarbrough Company for the three months Short Exercise 18 Prepare you prepared in as 22-23 Preparing an operating budget-sales and production budgets Learning Objective 3 Lago Company manufactures drinking glasses. One unit is a package of eight glasses, which sells for $30. Lugo projects sales for April will be 2,000 packages, with sales increasing by 250 packages per month for May, June, and July. On April 1, Lugo has 325 packages on hand but desires to maintain an ending inventory of 20% of the next month's sales. Prepare a sales budget and a production budget for Lugo for April, May, and June. May pkg. produced 2,300 y. E22-24 Preparing an operating budget-direct materials, direct labor, and Learning Objective 3 manufacturing overhead budgets Grady, Inc. manufactures model airplane kits and projects production at 650, 500, 450, and 600 kits for the next four quarters. Direct materials are 4 ounces of plastic per kit and the plastic costs $1 per ounce. Indirect materials are considered insignifi.- cant and are not included in the budgeting process. Beginning Raw Materials Inven- tory is 850 ounces, and the company desires to end each quarter with 10% of the materials needed for the next quarter's production. Grady desires a balance of 200 ounces in Raw Materials Inventory at the end of the fourth quarter. Each kit requires 0.10 hours of direct labor at an average cost of $10 per hour. Manufacturing over- 3rd Qtr. OH $255.00 Total is allocated using direct labor hours as the allocation base. Variable overhead is $0.20 per kit, and fixed overhead is $165 per quarter. Prepare Grady's direct materials budget, direct labor budget, and manufacturing overhead budget for the year Round tie direct labor hours needed for production, budgeted overhead costs, and prede- termined overhead allocation rate to two decimal places. Round other amounts to the 187,500 62,500 0 o s 250,000 nearest whole numbetr Riverbed's evise 1250 chapter 22 Note: Exercise E22-24 must be completed before attempting Exercise E22-25, Learning Objective 3E22-25 Preparing an operating budget-cost of goods sold budget Refer to the budgets prepared in Exercise E22-24. Determine the cost per kit to manufacture the model airplane kits. Grady projects sales of 100, 150, 100, and 200 kits for the next four quarters. Prepare a cost of goods sold budget for the year. Grady has no kits in beginning inventory. Round amounts to two decimal places. 3rd Qtr. COGS $550

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts