Question: PLEASE ANSWER 26, 27, 28, & 29. Please answer those four questions with working in neat format. will give upvote and good review. thanks :D

PLEASE ANSWER 26, 27, 28, & 29. Please answer those four questions with working in neat format. will give upvote and good review. thanks :D

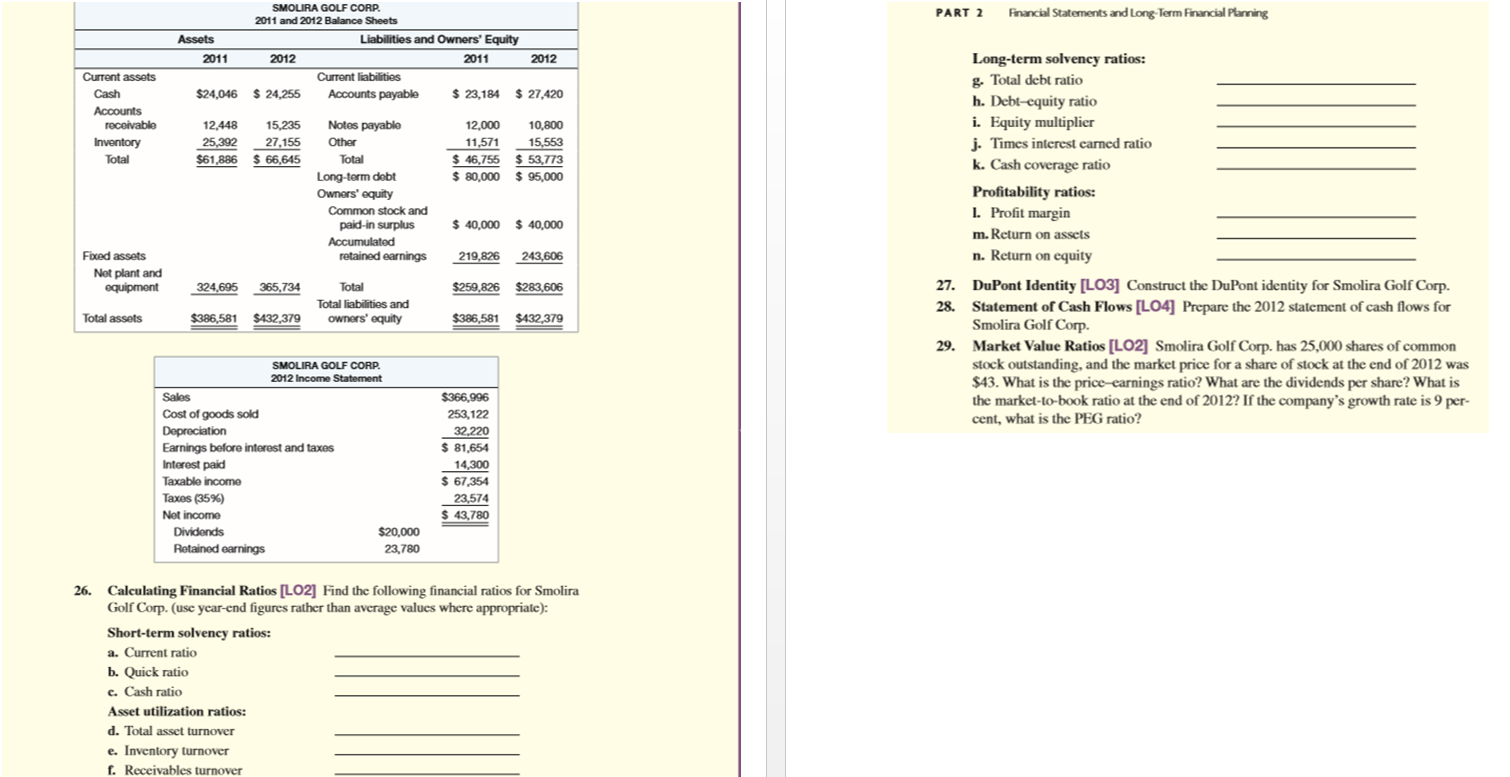

Current assets Cash Accounts Inventory Total Fixed assets Net plant and equipment Total assets receivable SMOLIRA GOLF CORP. 2011 and 2012 Balance Sheets 2011 2012 $24,046 $24,255 12,448 15,235 25,392 27,155 $61,886 $ 66,645 324,695 365,734 $386,581 $432,379 Assets Liabilities and Owners' Equity 2011 Current liabilities Accounts payable Notes payable Other Total Long-term debt Owners' equity Common stock and paid-in surplus Accumulated retained earnings Total Total liabilities and owners' equity SMOLIRA GOLF CORP. 2012 Income Statement 2012 $ 23,184 $ 27,420 12,000 10,800 11,571 15,553 $ 46,755 $53,773 $ 80,000 $ 95,000 $ 40,000 $40,000 219,826 243,606 $259,826 $283,606 $386,581 $432,379 Sales $366,996 253,122 Cost of goods sold Depreciation 32,220 Earnings before interest and taxes $ 81,654 Interest paid 14,300 Taxable income $ 67,354 Taxes (35%) 23,574 Not income $ 43,780 Dividends $20,000 23,780 Retained earnings 26. Calculating Financial Ratios [LO2] Find the following financial ratios for Smolira Golf Corp. (use year-end figures rather than average values where appropriate): Short-term solvency ratios: a. Current ratio b. Quick ratio c. Cash ratio Asset utilization ratios: d. Total asset turnover e. Inventory turnover f. Receivables turnover PART 2 Financial Statements and Long-Term Financial Planning Long-term solvency ratios: g. Total debt ratio h. Debt-equity ratio i. Equity multiplier j. Times interest earned ratio k. Cash coverage ratio Profitability ratios: 1. Profit margin m. Return on assets n. Return on equity 27. DuPont Identity [LO3] Construct the DuPont identity for Smolira Golf Corp. 28. Statement of Cash Flows [LO4] Prepare the 2012 statement of cash flows for Smolira Golf Corp. 29. Market Value Ratios [LO2] Smolira Golf Corp. has 25,000 shares of common stock outstanding, and the market price for a share of stock at the end of 2012 was $43. What is the price-earnings ratio? What are the dividends per share? What is the market-to-book ratio at the end of 2012? If the company's growth rate is 9 per- cent, what is the PEG ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts