Question: Please answer 2C and show work thank you 2. Consider the following securities and their sensitivities to two factors (the factors have zero means): Stock

Please answer 2C and show work thank you

Please answer 2C and show work thank you

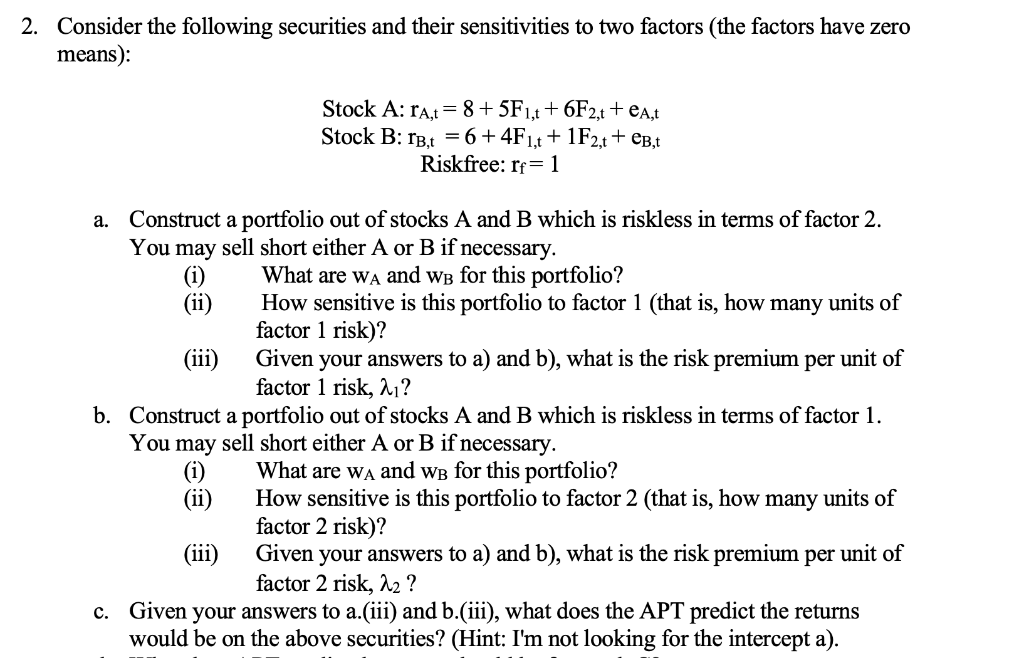

2. Consider the following securities and their sensitivities to two factors (the factors have zero means): Stock A: ra,t = 8 + 5F1,4 + 6F2,t + eat Stock B: 13,1 = 6 + 4F1,1 + 1F2, + B,t Riskfree: rf=1 a. Construct a portfolio out of stocks A and B which is riskless in terms of factor 2. You may sell short either A or B if necessary. (i) What are wa and wp for this portfolio? (ii) How sensitive is this portfolio to factor 1 (that is, how many units of factor 1 risk)? (iii) Given your answers to a) and b), what is the risk premium per unit of factor 1 risk, 21? b. Construct a portfolio out of stocks and B which is riskless in terms of factor 1. You may sell short either A or B if necessary. What are wa and WB for this portfolio? How sensitive is this portfolio to factor 2 (that is, how many units of factor 2 risk)? (iii) Given your answers to a) and b), what is the risk premium per unit of factor 2 risk, 22 ? c. Given your answers to a.(iii) and b.(iii), what does the APT predict the returns would be on the above securities? (Hint: I'm not looking for the intercept a). 2. Consider the following securities and their sensitivities to two factors (the factors have zero means): Stock A: ra,t = 8 + 5F1,4 + 6F2,t + eat Stock B: 13,1 = 6 + 4F1,1 + 1F2, + B,t Riskfree: rf=1 a. Construct a portfolio out of stocks A and B which is riskless in terms of factor 2. You may sell short either A or B if necessary. (i) What are wa and wp for this portfolio? (ii) How sensitive is this portfolio to factor 1 (that is, how many units of factor 1 risk)? (iii) Given your answers to a) and b), what is the risk premium per unit of factor 1 risk, 21? b. Construct a portfolio out of stocks and B which is riskless in terms of factor 1. You may sell short either A or B if necessary. What are wa and WB for this portfolio? How sensitive is this portfolio to factor 2 (that is, how many units of factor 2 risk)? (iii) Given your answers to a) and b), what is the risk premium per unit of factor 2 risk, 22 ? c. Given your answers to a.(iii) and b.(iii), what does the APT predict the returns would be on the above securities? (Hint: I'm not looking for the intercept a)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts