Question: Please answer 33 through 36. 33. While working in the orthopedic office, Robert slips and falls, severely fracturing his arm. The fracture requires surgery and

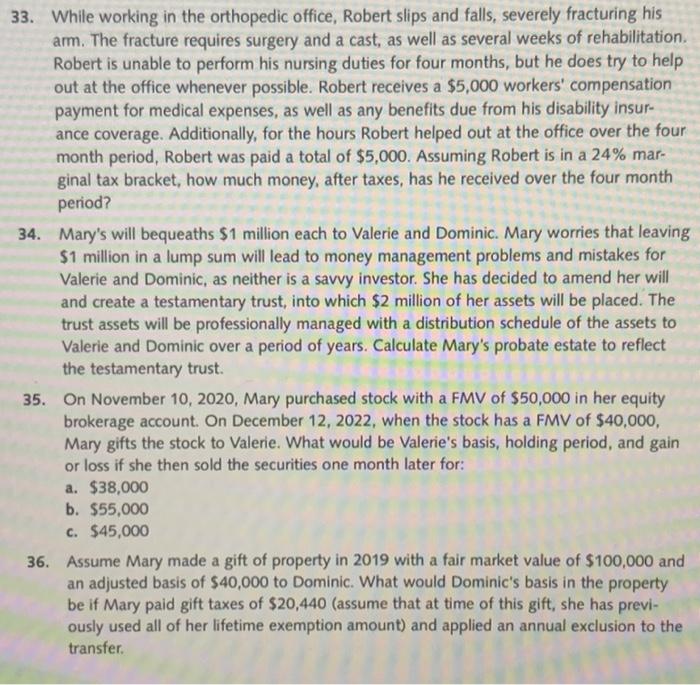

33. While working in the orthopedic office, Robert slips and falls, severely fracturing his arm. The fracture requires surgery and a cast, as well as several weeks of rehabilitation Robert is unable to perform his nursing duties for four months, but he does try to help out at the office whenever possible. Robert receives a $5,000 workers' compensation payment for medical expenses, as well as any benefits due from his disability insur- ance coverage. Additionally, for the hours Robert helped out at the office over the four month period, Robert was paid a total of $5,000. Assuming Robert is in a 24% mar- ginal tax bracket, how much money, after taxes, has he received over the four month period? 34. Mary's will bequeaths $1 million each to Valerie and Dominic. Mary worries that leaving $1 million in a lump sum will lead to money management problems and mistakes for Valerie and Dominic, as neither is a savvy investor. She has decided to amend her will and create a testamentary trust, into which $2 million of her assets will be placed. The trust assets will be professionally managed with a distribution schedule of the assets to Valerie and Dominic over a period of years. Calculate Mary's probate estate to reflect the testamentary trust. 35. On November 10, 2020, Mary purchased stock with a FMV of $50,000 in her equity brokerage account. On December 12, 2022, when the stock has a FMV of $40,000, Mary gifts the stock to Valerie. What would be Valerie's basis, holding period, and gain or loss if she then sold the securities one month later for: a. $38,000 b. $55,000 c. $45,000 36. Assume Mary made a gift of property in 2019 with a fair market value of $100,000 and an adjusted basis of $40,000 to Dominic. What would Dominic's basis in the property be if Mary paid gift taxes of $20,440 (assume that at time of this gift, she has previ- ously used all of her lifetime exemption amount) and applied an annual exclusion to the transfer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts