Question: While working in the orthopedic office, Robert slips and falls, severely fracturing his arm. The fracture requires surgery and a cast, as well as several

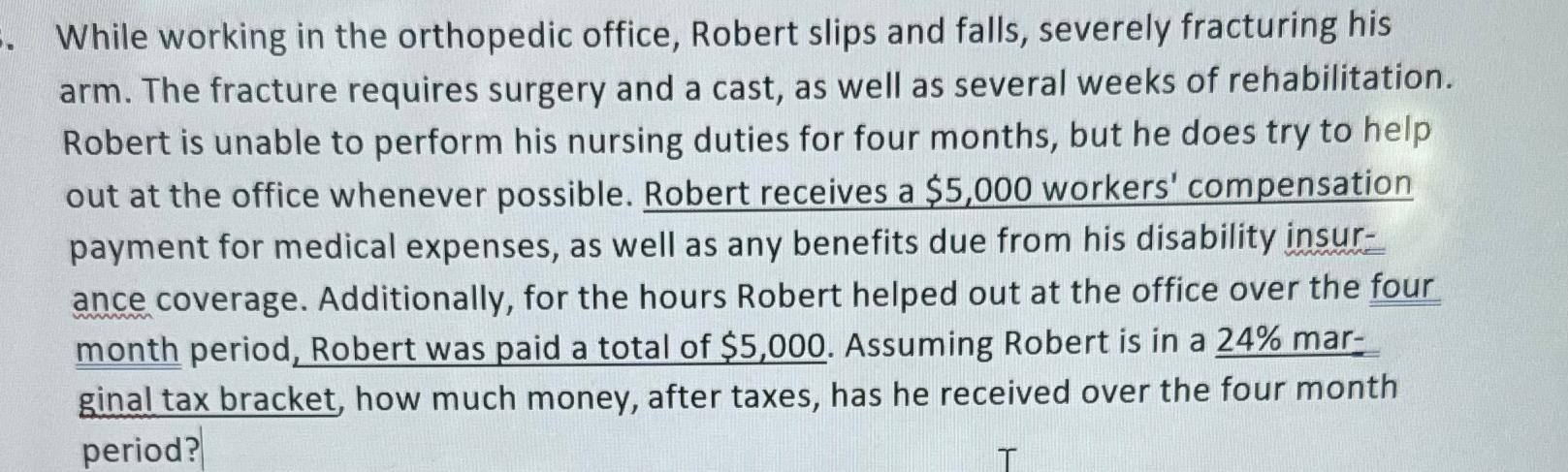

While working in the orthopedic office, Robert slips and falls, severely fracturing his arm. The fracture requires surgery and a cast, as well as several weeks of rehabilitation. Robert is unable to perform his nursing duties for four months, but he does try to help out at the office whenever possible. Robert receives a $ workers' compensation payment for medical expenses, as well as any benefits due from his disability insurance coverage. Additionally, for the hours Robert helped out at the office over the four month period, Robert was paid a total of $ Assuming Robert is in a marginal tax bracket, how much money, after taxes, has he received over the four month period?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock