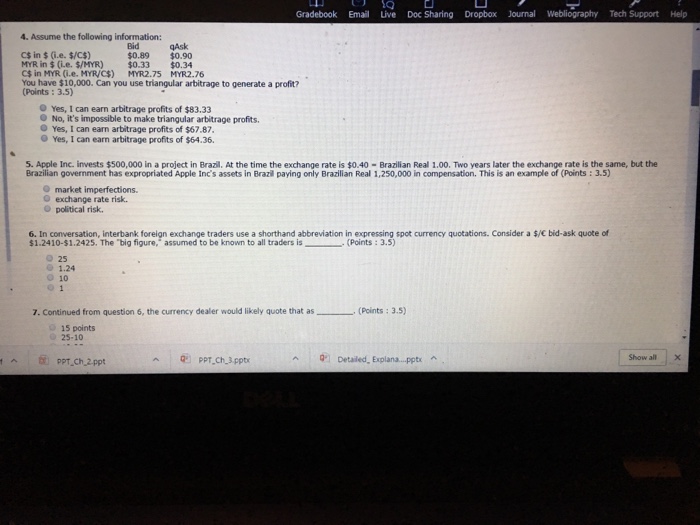

Question: Please answer 4, 5, & 6. Gradebook Ema Live Doc Sharing Dropbox Journal Webliography Tech Support Help 4. Assume the following information: Bid qAsk $0.89

Please answer 4, 5, & 6.

Please answer 4, 5, & 6. Gradebook Ema Live Doc Sharing Dropbox Journal Webliography Tech Support Help 4. Assume the following information: Bid qAsk $0.89 $0.90 C$ in $ (G.e. $/C$) MYR in $ (ie. $/MYR) $0.33 $0.34 C$ in MYR (i.e. MR/CS) MYR2.75 MYR2.76 You have $10,000. Can you use triangular arbitrage to generate a profit? (Points : 3.5) O Yes, I can earn arbitrage profits of $83.3:3 O No, it's impossible to make triangular arbitrage profits. O Yes, I can earn arbitrage profits of $67.87, Yes, I can earn arbitrage profits of $64.36 5. Apple Inc. invests $500,000 in a project in Brazill. At the time the exchange rate is $0.40-Brazilian Real 1.00. Two years later the exchange rate is the same, but the Brazilian government has expropriated Apple Inc's assets in Brazil paying only Brazilian Real 1,250,000 in compensation. This is an example of (Points : 3.5) O market imperfections. O exchange rate risk. O political risk. 6. In conversation, interbank foreign exchange traders use a shorthand abbreviation in expressing spot currency quotations. Consider a $/C bid-ask quote of $1.2410-$1.2425. The "big figure," assumed to be known to all traders is (Points : 3.5) o 25 1.24 0 10 7. Continued from question 6, the currency dealer would likely quote that as " (Points : 3.5) 15 points 25-10 PPT Ch, 2 ppt Show all x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts