Question: Please answer 4,5&6 Gradebook Email Live Doc Sharing Dropbox Journal Webliography Tech Support Help . Currency carry trade (Points: 3.5) interest O involves buying a

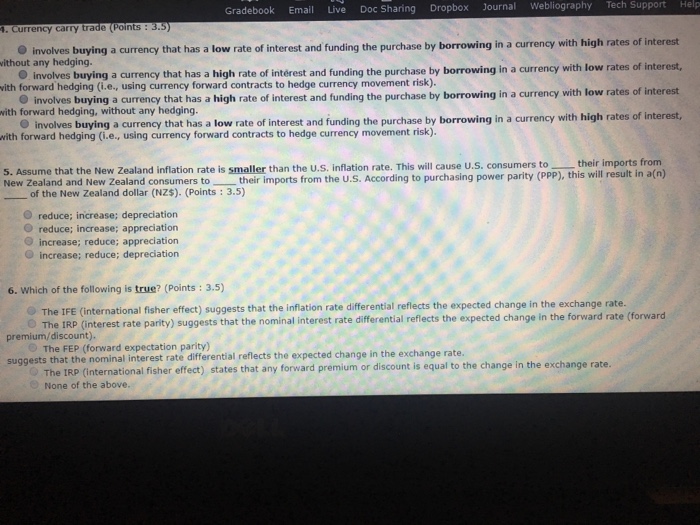

Gradebook Email Live Doc Sharing Dropbox Journal Webliography Tech Support Help . Currency carry trade (Points: 3.5) interest O involves buying a currency that has a low rate of interest and funding the purchase by borrowing in a currency with high rates of ithout any hedging. for warod es biryi do a uairency thatchtora anglb nate of itrest andfuding the purctase by bcurency with low rats f 0 involves buying a currency that has a high rate of interest and funding the purchase by borrowing in a currency with low rates of interest with forward hedging, without any hedging. with forward hedging (i.e., using currency forward contracts to hedge currency movement risk) 5. Assume that the New Zealand inflation rate is smaller than the U.S. inflation rate. This will cause U.S. consumers to O involves buying a currency that has a low rate of interest and funding the purchase by borrowing in a currency with high rates of interest, their imports from New Zealand and New Zealand consumers to tir imports from the U.S. According to purchasing power parity (PPP), this will result in a(n) of the New Zealand dollar (NZS). (Points : 3.5) O reduce; increase; depreciation O reduce; increase; appreciation increase; reduce; appreciation O increase; reduce; depreciation 6. Which of the following is true? (Points : 3.5) The IFE (international fisher effect) suggests that the inflation rate differential reflects the expected change in the exchange rate. 0 The IRP (interest rate parity) suggests that the nominal interest rate differential reflects the expected change in the forward rate (forward premium/discount). The FEP (forward expectation parity) tial reflects the expected change in the exchange rate. suggests that the nominal interest rate differen The IRP (international fisher effect) states that any forward premium or discount is equal to the change in the exchange rate None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts