Question: Please answer: 4. Compare TJXs business segments. Which segment appears to have the greatest potential? Are any business units a detriment to overall corporate performance?

Please answer:

4. Compare TJXs business segments. Which segment appears to have the greatest potential? Are any business units a detriment to overall corporate performance? Support your answer. 5. Does TJX have a good internet versus brick-and-mortar mix? Are there opportunities to revise the retailing approach of its business units? 6. What recommendations would you make to TJX management to improve business unit and corporate performance? Support your recommendations.

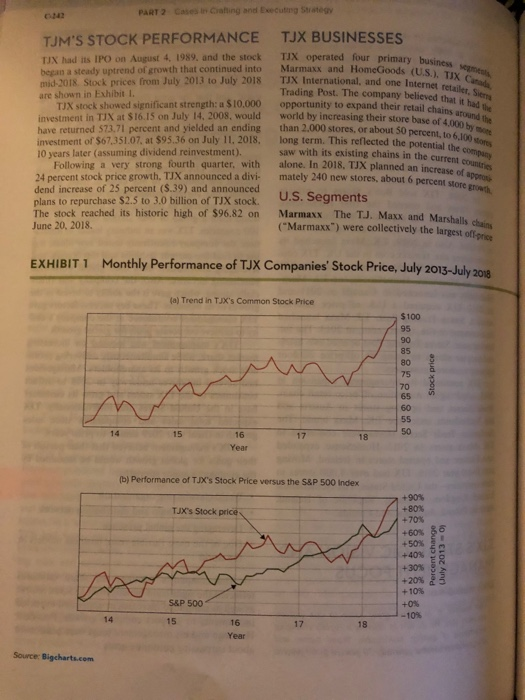

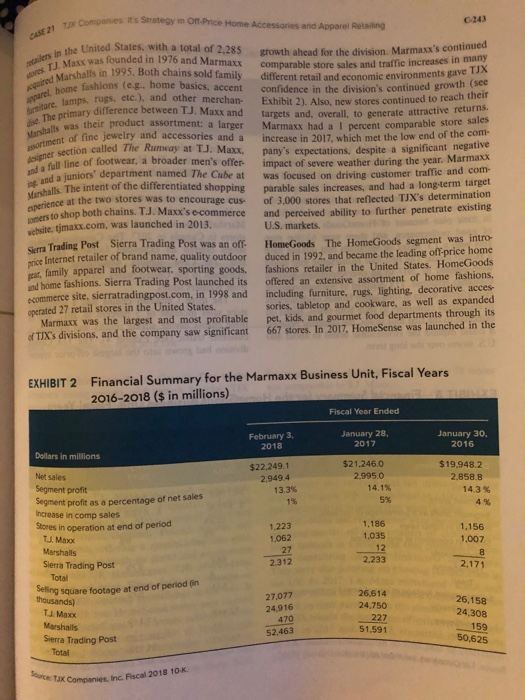

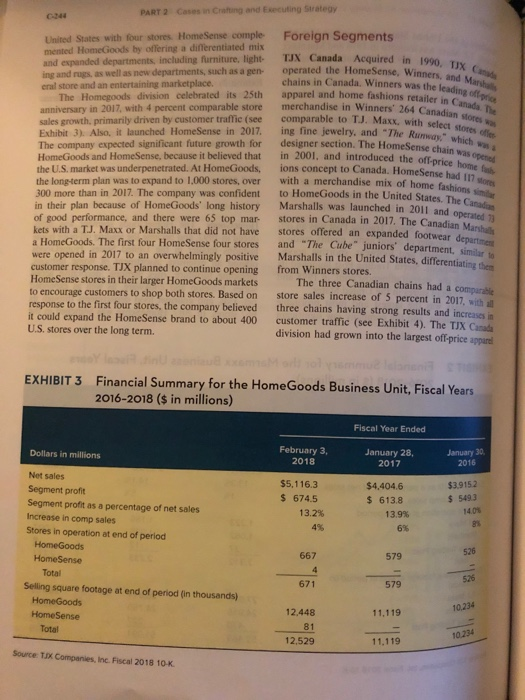

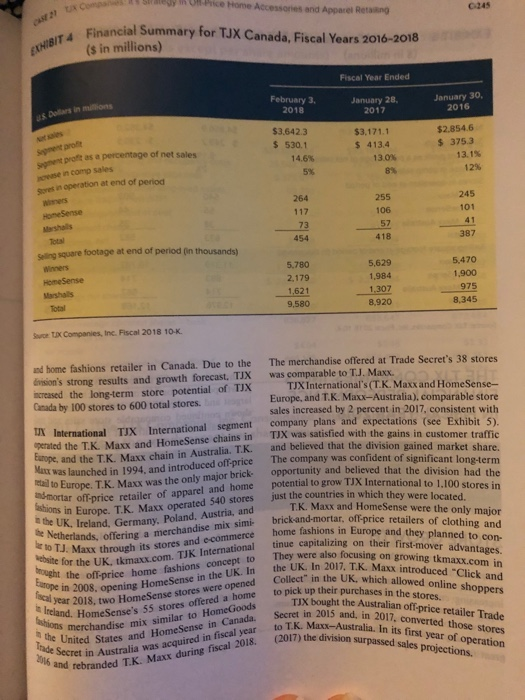

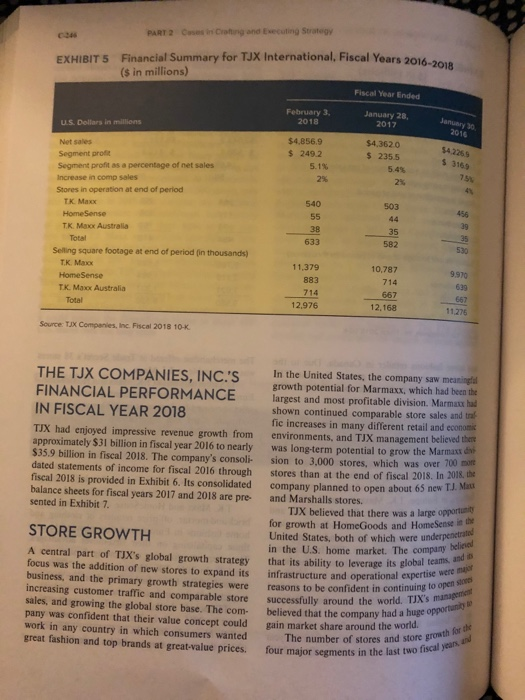

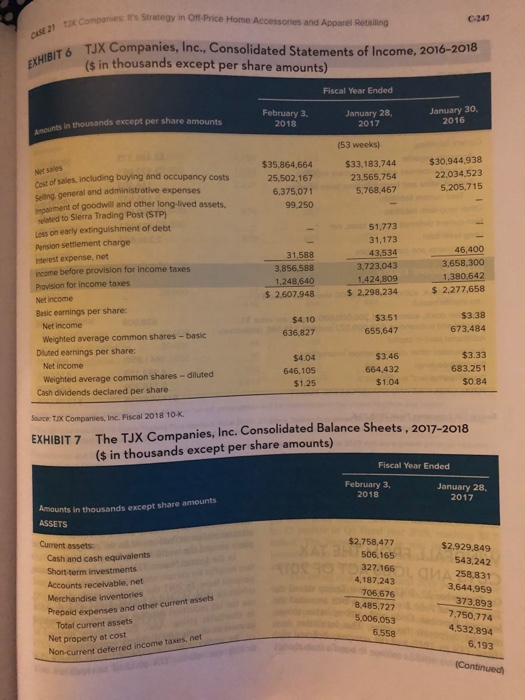

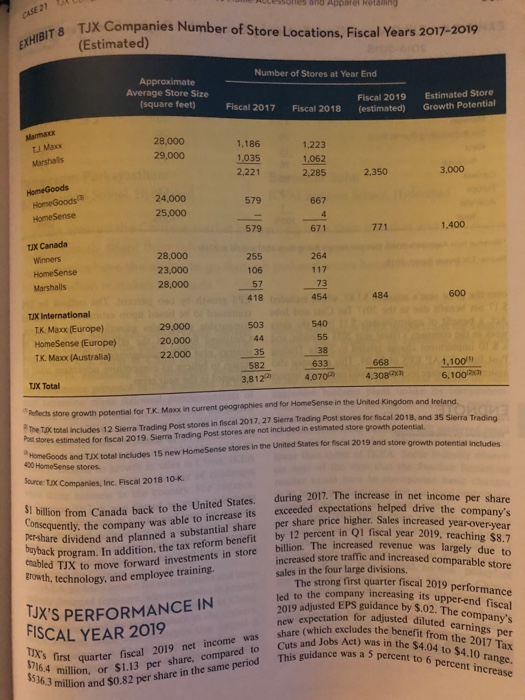

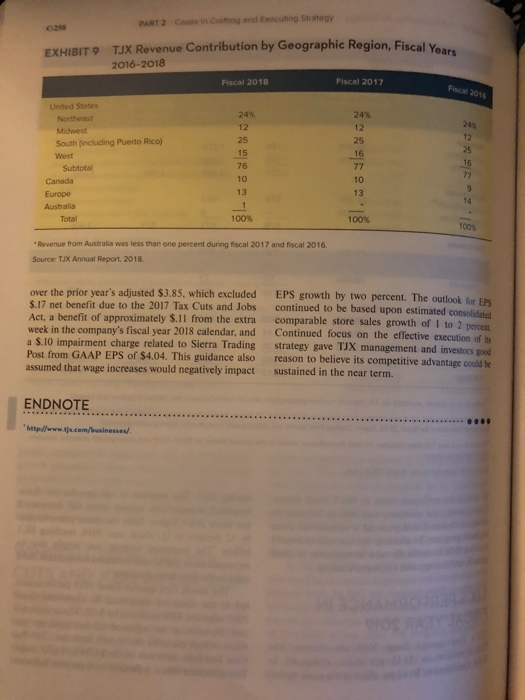

CASE 21 TJX Companies: It's Strategy in Off-Price Home Accessories and Apparel Retailing David L. Turnipseed University of South Alabama n February 2018, TUX Companies, Inc., the world's largest off-price home accessories and apparel retailer, completed 42 years of operations with sev. eral enviable milestones: the company had edged up to number 85 on the Fortune 500, surpassed $35 billion in sales, and opened its 4,000th store, guided by a highly effective global strategy. Sales had grown over eight percent and comparable store sales increased 2 percent in fiscal year 2018. In the company's 42-year history, it had experienced an annual decline in comparable store sales in only one year. The strong earnings trend enabled TJX to increase its per share dividends for fiscal 2019 by 20 percent, which made 21 consecutive years of dividend increases. Ernie Herrman, the President and CEO of TJX. looked back at his first year in charge of the huge, inter- national off-price retailer with great satisfaction. As the TJX Companies moved into fiscal 2019, President Herrman pondered how to keep the company on the same upward trajectory. Although the TJX Companies had one small chain that was primarily e-commerce, and its brick-and-mortar chains had e-commerce capa- bilities, in a world ostensibly focused on e-commerce, TJX had been very successful concentrating on its brick-and-mortar chains. Given TJX's steadily increas- ing sales and profits in its present structure, should the company divert part of its attention and resources, and attempt to boost its internet sales? Also, given the outstanding sales growth driven by opening new stores worldwide, should the company stay the course, or would concentration on certain geographical loca- tions produce more sales and profits? TJX: AN OVERVIEW TJX traced its origin to the Feldberg cousins who opened their Zayre (Yiddish for "very good") dis count store in Hyannis, Massachusetts in 1956. Over the years, Zayre purchased a women's clothing chain, opened Chadwick's of Boston, launched a mem- bership warehouse club, and a home improvement chain. The first TJ. Maxx opened in Auburn, MA in 1977, offering off-price upscale family apparel. In 1987, the Zayre's off-price chains were organized as the TJX Companies, Inc., which were operated as a subsidiary of Zayre. Also in 1987, TJX had an IPO, with Zayre retaining 83 percent ownership. In 1989. Zayre divested its warehouse club division, and acquired minority ownership in TJX companies that had been publically traded. Zayre merged with TIX and then adopted the name of its former subsidiary In 1990, TJX acquired Winners Apparel Lid, a Canadian chain similar to TJ. Maxx, and this chain became Canada's largest off-price stores. Two years later, in 1992, HomeGoods, offering home fashions from around the world, was launched in the United States. TJX ventured overseas in 1994 and opened T.K. Meu in the United Kingdom (UK) and Ireland. Over time T.K. Maxx became the only major brick and mortar off- price retailer of home fashions and apparel in Europe In 1995, TJX acquired the 496 store Marshalls chain, which was the second largest off-price retailer of brand name family apparel in the United States. Copyright 2018 by David L. Turnipsed. All rights reserved TJX Canada Acquired in 1990. TUX Can operated the HomeSense, Winners, and Marshall chains in Canada. Winners was the leading of apparel and home fashions retailer in Canada. The merchandise in Winners 264 Canadian states was comparable to TJ. Maxx, with select stores of ing fine jewelry, and "The Runway, which w designer section. The HomeSense chain was opened in 2001, and introduced the off-price home for ions concept to Canada. HomeSense had 117 with a merchandise mix of home fashions similar to HomeGoods in the United States. The Canadian PART 2 Cases in Cating and Executing Strategy Foreign Segments United States with four stores HomeSense comple mented HomeGoods by offering a differentiated mix and expanded departments, including furniture, light- ing and rugs, as well as new departments, such as a gen- eral store and an entertaining marketplace. The Homegoods division celebrated its 25th anniversary in 2017, with 4 percent comparable store sales growth, primarily driven by customer traffic (see Exhibit 3). Also, it launched HomeSense in 2017, The company expected significant future growth for HomeGoods and HomeSense, because it believed that the U.S. market was underpenetrated. At HomeGoods, the long-term plan was to expand to 1.000 stores, over 300 more than in 2017. The company was confident in their plan because of HomeGoods' long history of good performance, and there were 65 top mar kets with a TJ. Maxx or Marshalls that did not a HomeGoods. The first four HomeSense four stores were opened in 2017 to an overwhelmingly positive customer response. TJX planned to continue opening HomeSense stores in their larger HomeGoods markets to encourage customers to shop both stores. Based on response to the first four stores, the company believed it could expand the HomeSense brand to about 400 U.S. stores over the long term. Marshalls was launched in 2011 and operated 13 stores in Canada in 2017. The Canadian Marshall stores offered an expanded footwear departmen and "The Cube" juniors' department, similar to Marshalls in the United States, differentiating the from Winners stores. The three Canadian chains had a comparable store sales increase of 5 percent in 2017, with three chains having strong results and increases in customer traffic (see Exhibit 4). The TJX Canada division had grown into the largest off-price apparel EXHIBIT 3 Financial Summary for the Home Goods Business Unit, Fiscal Years 2016-2018 ($ in millions) Fiscal Year Ended Dollars in millions February 3, 2018 January 28, 2017 January 30 2016 Net sales Segment profit Segment profit as a percentage of net sales Increase in comp sales Stores in operation at end of period Home Goods HomeSense $5,116.3 $ 674.5 13.2% 4% $4,404.6 $ 613.8 13.9% 6% $3.9152 $ 5493 1408 88 579 526 667 4 Total 526 671 579 Selling square footage at end of period (in thousands) Home Goods HomeSense Total 10,234 11.119 12.448 81 12,529 10 234 11,119 Source: TAX Companies, Inc. Fiscal 2018 10KStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts