Question: please answer 4,5,6! 4. 5. Use principle +5 to explain why investors should not buy hot stocks. Use principle 45 to explain why investors should

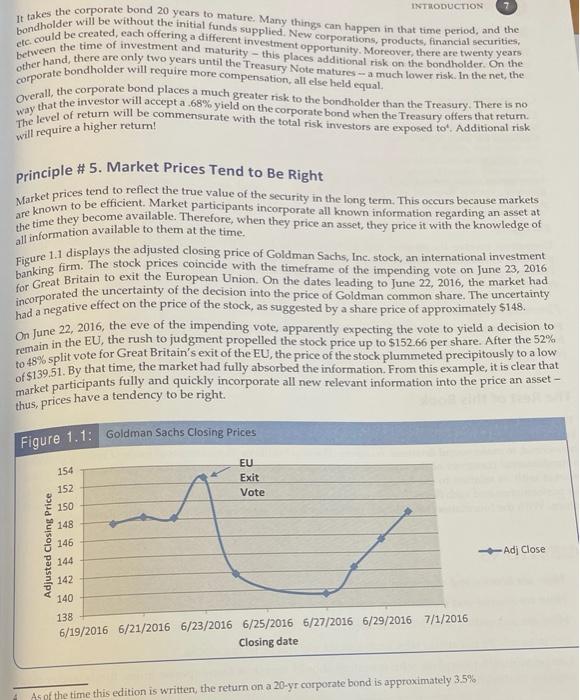

4. 5. Use principle +5 to explain why investors should not buy "hot stocks." Use principle 45 to explain why investors should invest in low-expense index funds, rather than popular mutual funds managed by well-known money managers with additional expenses. INTRODUCTION 6. Explain, using one of the principles of finance, why some people choose to invest in speculative, risky options that expose investors to a great deal of risk and others invest in U.S. Treasury bonds. Market prices tend to be right ( a 1 1 5. Principle # 1. Interest rates reflect opportunity costs now and in the future, is based on the real interest rate. An individual's lifetime income streams are A simple two-generational model will illustrate that an individual's choice on the quantity of consumption Lifetime consumption (spending) streams are represented by C and C; where C and C, are current and depicted as y, and y, where y, represents income in the present time, and y, represents future income in the future. Unless r has a value of zero, this means that the future value will always be greater than can save at the real risk-free interest rate and earn a risk-free return to improve his expenditure position future consumption (spending), respectively. Lastly, r is the real risk-free interest rate. An individual present. The individual's lifetime budget constraint is written as: Equation 1-1. y This expression is to be interpreted as: 0 G 1+r 1+ present value of lifetime income = present value of lifetime consumption We solve this expression for present consumption or expenditure: y C = y + 1+7 1+r Simplifying the right-hand side of the equation, present we get cn = y, now, 1+r value of income not consumed from the future. The maximum that can be spent today is equal to all This equation states that current spending (consumption) is equal to present income plus the of today's income plus the present value of future income. If the individual chose to spend nothing then they can spend, in addition to what they earn in the future, all that they save now. Note borrow from future income. Most importantly, notice that the coefficient of is. Holding future income 1+1 an increase in future consumption decreases current consumption by a Ace-1 opportunity cost of consumption , factor The marginal effect on the constant 1+1 of -1 The 1+ opportunity cost is positive This indicates that the real risk-free interest rate of interest positively affects the opportunity of consumption. When interest rates rise, so does the opportunity cost. Ac AC Ar 1 3 20 INTRODUCTION Principle # 2. Cash is King Don't be duped: When assessing the value of a project, cash matters, not profit! For several reasons probits can be misleading. We will spend a great deal of time looking at financial statements. As we do recorded as they are incurred, there could be striking differences between net income and cash. Due to so we will see that because financial statements engage in accrual accounting where transactions are crual accounting, some expenses incurred do not actually use cash. However, credit sales are recorded as sales and until collected, are also recorded as accounts receivables is recorded in the firm's income statement. Cash sales result in cash revenues and obviously are cash The top line of all income statements are revenues, or sales. If a business makes a sale, credit or cash, it (including other debits and credits on the balance sheet). At some point in the future, it will be decided that some bad credit sales will not be collected. These accounts will be written off on the balance sheet as an allowance for bad credit sales, reducing the outstanding accounts receivable. The second common account that distorts net income is depreciation and amortization expenses Depreciation expense accounts for the fact that fixed assets do not have perpetual lives. Generally Accepted Accounting Practices (GAAP) allows for the expensing of an asset's used life, over time. Each fixed asset has a generally accepted useful life. There are various accounting methods for depreciation: straight line, declining balance, etc. Each one expenses depreciation in a different way. As can be imagined, this will affect net income, sometimes significantly. Therefore, sales do not always result in When a business acquires another business at a price greater than the value of the assets on the balance as fixed assets have finite lives and must be used over time, so must goodwill. The non-cash expenditure sheet, it is required to account for this difference as Goodwill, an intangible asset on the balance sheet. Just of goodwill is called amortization. It shows up as a non-cash expenditure on the income statement, and more importantly, contributes to the distortion of net income. Income taxes are another form of misconception that may alter the bottom line. The firm's marginal tax 1 cash flows! misstate profits, and consequently, cash flows. pate is used to record the tax expense incurred for the accounting period. The degree to which cash flows de impacted have to do with tax laws. However, local, state, and federal tax codes are fairly complex, not result in actual tax paid. This has the tendency to Depending on the form and its transactions, there may be other non-cash expenditures that will be recorded on the firm's income statement, that for reasons already noted, will distort the firm's profit Tevel and cash flows. These non-standard expenses are often recorded as "other" expenditures on the For these reasons, financial managers and analysts must convert profits to cash! income statement Principle # 3. There is a time value to money All else equal, it is better to have money now than in the future. This principle is arguably the load-bearing column of finance. As the age-old doctrine, "Time heals all wounds" goes, time is essential to finance as well. Money has an opportunity cost. This important concept can best be demonstrated with an example. Consider a 10% 30-year corporate bond with a face value of $1,000. If interest is paid annually, the issuer of the bond will make annual payments of ( 10 x 1,000) $100 each year to the bond holder. These contractual cash flows will be paid each year for thirty years, and at the terminal period of 30 years, the principal of 1,000 will be repaid to the bondholder. If money had no opportunity cost, meaning that there is no foregone alternative from not having made the investment, then it would appear that the value of the CHAPTER 1 1 1 When the bondholder purchases the bond for $1.000, he is contractually entitled to receive an annual bond would be 54,000! As we can easily point out this price is flawed. However, The bondholder does have an opportunity cost. Let's assume that the bondholder faces an opportunity cost of 10% per annum However, this principal amount of $1,000 that he is to be paid in 30 years at maturity is not worth $1,000 interest payment of $100 followed by principal amount of $1,000 at the time of maturity in 30 years initial amount sx today to receive $1,000 in 30 years. The unknown amount can be found by solving the to him day. If he could eam 10% per year from a similar investment, he would only have to investan 1 1 equation: *(1 + 10)(1+10) - (1+.10) = 1,000 X (1+.103"-1,000 - $57.31 The potential bondholder would have no incentive to pay one cent more. This concept would be applied to each of the cash flows to be received from the bond -all 31 of them in total (30 interest payments and the principal balance). When the opportunity cost is accounted for, the most that the potential investor suggests that value bond. Principle # 4. Risk Affects Return Most individuals are risk-averse. That is given two mutually exclusive options, unless fairly compensated. different bonds to invest in. Bond 1 is a 2-yr U.S. Treasury Note and the other is a 20-yr A-rated corporate the option with lesser risk will be preferred over the other. Consider an individual deciding between telo If the yield on the Treasury Note is 0.68%, what is likely to be the yield on the 20-yr A rated corporate bond? To answer that question, let's look at the kinds of risk that an investor is exposed to with both bonds The 2-yr Treasury is a fixed interest debt instrument, offering the same interest payment periodically to its bond holders. Therefore, it is subject to inflation and interest rate sensitivity. Within the two years before maturity, inflation rates may rise and bondholders with fixed interest payments will not be able to maneuver around this, hurting their real return. This could hurt bondholders, so they would want to be compensated for this. In the same way, this phenomenon will also hurt the corporate bondholder. What if the Treasury bondholder wanted to liquidate their position in the bond? The market for Treasury Bonds is large and decentralized. He may sell it to Treasury Bond Dealers who are easily accessible in the financial market . Ultimately, he can sell it to the issuer, the US. Treasury. It is widely accepted that a Treasury Bond, being the security of choice because of its safety, is easily liquidated without much loss in value. On the other hand, if you wanted to sell the A rated 20-yr corporate bond, you would have to find a broker or dealer that specializes in that bond. The offer (rate at which the dealer will buy the) and ask (dealer likely to sell the bond) prices are likely to be far apart, due to its lack of depth and scope in the bond market. This places a larger liquidity risk to the bondholder, making corporate bondholders require a higher premium on its total yield. The US Treasury has never defaulted on its bonds and the Treasury securities are regarded as the safest on the market. Therefore, it practically places zero risk in terms of default. The A-rated corporate bond. on the other hand, has a much higher probability of default. Corporations file bankruptcy frequently, and since the bond is only rated "A", bond rating companies like Fitch, have determined these bonds to be of much lower quality in relations to the Treasury Note. Therefore, a potential bondholder will want to be fairly compensated for this greater risk. INTRODUCTION It takes the corporate bond 20 years to mature. Many things can happen in that time period, and the bondholder will be without the initial funds supplied New corporations, products, financial securities, between the time of investment and maturity - this places additional risk on the bondholder. On the etc. could be created, each offering a different investment opportunity. Moreover, there are twenty years other hand, there are only two years until the Treasury Note matures a much lower risk. In the net, the corporate bondholder will require more compensation, all else held equal Overall, the corporate bond places a much greater risk to the bondholder than the Treasury. There is no way that the investor will accepta 68% yield on the corporate bond when the Treasury offers that retum. The level of return will be commensurate with the total risk investors are exposed to Additional risk will require a higher retum! Principle # 5. Market Prices Tend to Be Right Market prices tend to reflect the true value of the security in the long term. This occurs because markets the time they become available. Therefore, when they price an asset, they price it with the knowledge of are known to be efficient Market participants incorporate all known information regarding an asset at all information available to them at the time. Figure 1.1 displays the adjusted closing price of Goldman Sachs, Inc. stock, an international investment banking firm. The stock prices coincide with the timeframe of the impending vote on June 23, 2016 for Great Britain to exit the European Union. On the dates leading to June 22, 2016, the market had incorporated the uncertainty of the decision into the price of Goldman common share. The uncertainty had a negative effect on the price of the stock, as suggested by a share price of approximately $148. remain in the EU, the rush to judgment propelled the stock price up to $152.66 per share. After the 52% , 12 48% split vote for Great Britain's exit of the EU, the price of the stock plummeted precipitously to a low of $139.51. By that time, the market had fully absorbed the information. From this example, it is clear that market participants fully and quickly incorporate all new relevant information into the price an asset - thus, prices have a tendency to be right Figure 1.1: Goldman Sachs Closing Prices EU Exit Vote 154 152 150 148 Adjusted Closing Price 146 Adj Close 144 142 140 138 6/19/2016 6/21/2016 6/23/2016 6/25/2016 6/27/2016 6/29/2016 7/1/2016 Closing date As of the time this edition is written the return on a 20-yr corporate bond is approximately 3.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts