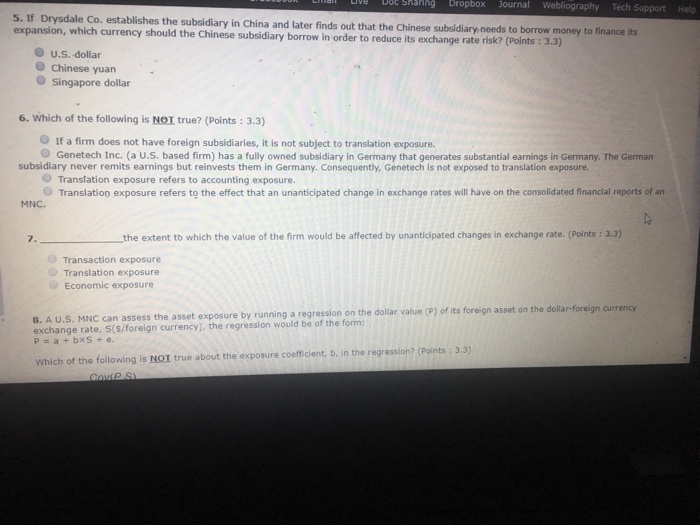

Question: Please answer 5,6,&7 e Sharing bropbox Journal Webliography Tech Support Help 5. If Drysdale Co. establishes the subsidiary in China and later finds out that

e Sharing bropbox Journal Webliography Tech Support Help 5. If Drysdale Co. establishes the subsidiary in China and later finds out that the Chinese subsidiary, needs to borrow money to expansion, which currency should the Chinese subsidiary borrow in order to reduce its exchange rate O u.s. dollar O Chinese yuan O Singapore dollar 6. Which of the following is NOT true? (Points :3.3) O If a firm does not have foreign subsidiaries, it is not subject to translation exposure. Genetech Inc. a u s based firm has a fully owned subsidiary in Germany that generates substantial earnings in Germany. The German subsidiary never remits earnings but reinvests them in Germany. Consequently, Genetech is not exposed to translation exposure. O Translation exposure refers to accounting exposure. Translation exposure refers to the effect that an unanticipated change in exchange rates will have on the consolidated financial reports of an MNC. 7 te extent tb which the value of the firm would be affected by unanticipated changes in exchange rate. (Points : 3.3) Transaction exposure Translation exposure Economic exposure exposure by running a regression on the dollar value (P) of its foreign asset on the dollar-foreign currency 8. A U.S. MNC can assess the asset exchange rate, S(S/foreign currency), the regression would be of the form: Which of the following is NOT true about the exposure coefficient, b, in the regression? (Points : 3.3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts