Question: please answer 6,7,8 Section Review Three Questions v2.pdf a a 6 Five years ago, you bought $25 mil Face Value of Caterpillar (BBB Rated) 4%

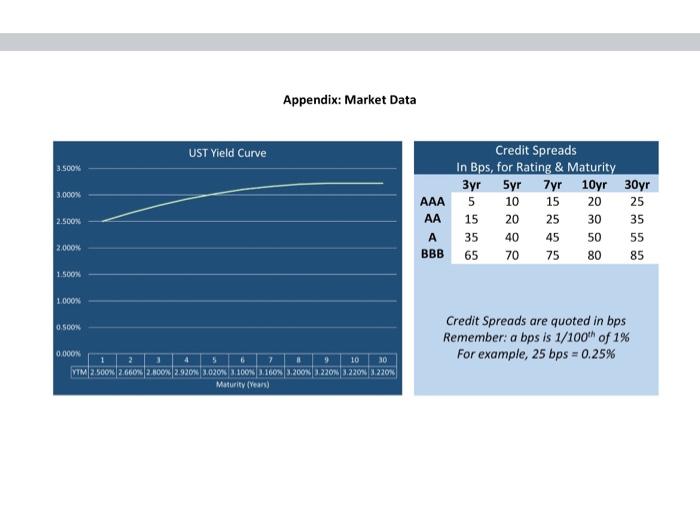

Section Review Three Questions v2.pdf a a 6 Five years ago, you bought $25 mil Face Value of Caterpillar (BBB Rated) 4% 10yr bonds at a YTM of 4.380%. What was the amount of your initial investment amount (ie what was their value when you bought them) (5 in millions, to two decimal places)? 7 Five years ago, you bought $25 mil Face Value of Caterpillar (BBB Rated) 4% 10yr bonds at a YTM of 4.375%. What are your holdings worth today, using current market conditions in the Appendix ($ in millions, to two decimal places)? 8. If today you could sell the Caterpillar Bonds at a price of 104.000, what would be the YTM (% to two decimal places)?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts