Question: Please answer 7-2 through 7-6 if possible thank you!! You are considering several securities for potential investment. Your investment advisor has provided you with the

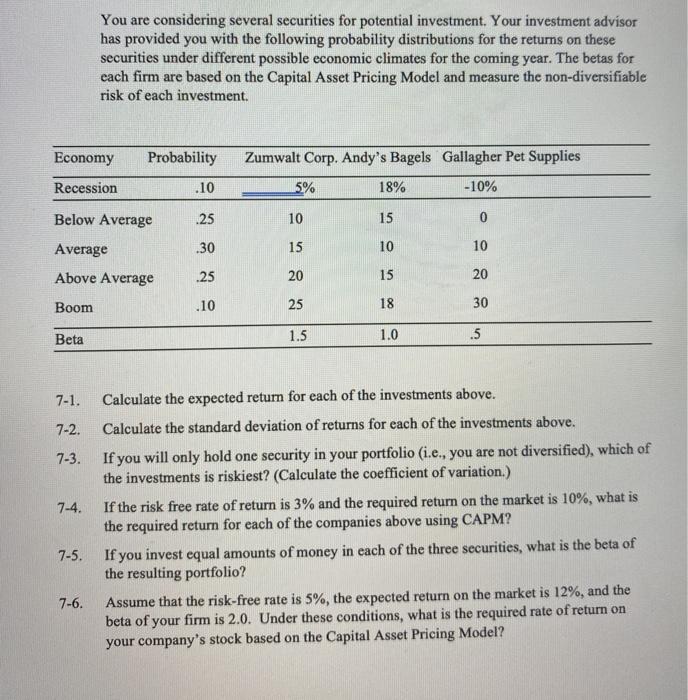

You are considering several securities for potential investment. Your investment advisor has provided you with the following probability distributions for the returns on these securities under different possible economic climates for the coming year. The betas for each firm are based on the Capital Asset Pricing Model and measure the non-diversifiable risk of each investment. Economy Probability Zumwalt Corp. Andy's Bagels Gallagher Pet Supplies Recession .10 5% 18% -10% Below Average .25 10 15 0 .30 15 10 10 Average Above Average .25 20 15 20 Boom .10 25 18 30 Beta 1.5 1.0 .5 7-1. 7-2. 7-3. 74. Calculate the expected return for each of the investments above. Calculate the standard deviation of returns for each of the investments above. If you will only hold one security in your portfolio (i.e., you are not diversified), which of the investments is riskiest? (Calculate the coefficient of variation.) If the risk free rate of return is 3% and the required return on the market is 10%, what is the required return for each of the companies above using CAPM? If you invest equal amounts of money in each of the three securities, what is the beta of the resulting portfolio? Assume that the risk-free rate is 5%, the expected return on the market is 12%, and the beta of your firm is 2.0. Under these conditions, what is the required rate of return on your company's stock based on the Capital Asset Pricing Model? 7-5. 7-6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts