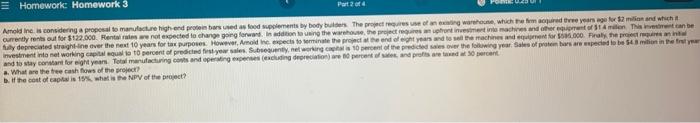

Question: please answer a and b Homework: Homework 3 Part 2 of 4 Amold in considering a proposal to manufacture high end protein barsed as food

Homework: Homework 3 Part 2 of 4 Amold in considering a proposal to manufacture high end protein barsed as food supplements by body but The progress in warehone, which the more tree years age for $2 million and which currently rents out for $122.000. Rentement expected to change going forward. In addition to using the warehouse. The project proteiner inte machine anderen of 114 in This man be ay deprecated straight line over the next 10 years for the purposes. However, Arnold he expects to seminate the project and years and to all the machines and went for M.000 ray the pred Investment into networking capital soul to to percent of predicted frost your se Subs, networking at a 10 percent of the predicted over the following year. Shes of protein bars are expected to be mine and to y constant for eight years Total manufacturing cons and operating acting in een and prosperont a. What are the tree cash flow of the project? b. If the cost of capis 15%, what is NPV of the project? Homework: Homework 3 Part 2 of 4 Amold in considering a proposal to manufacture high end protein barsed as food supplements by body but The progress in warehone, which the more tree years age for $2 million and which currently rents out for $122.000. Rentement expected to change going forward. In addition to using the warehouse. The project proteiner inte machine anderen of 114 in This man be ay deprecated straight line over the next 10 years for the purposes. However, Arnold he expects to seminate the project and years and to all the machines and went for M.000 ray the pred Investment into networking capital soul to to percent of predicted frost your se Subs, networking at a 10 percent of the predicted over the following year. Shes of protein bars are expected to be mine and to y constant for eight years Total manufacturing cons and operating acting in een and prosperont a. What are the tree cash flow of the project? b. If the cost of capis 15%, what is NPV of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts