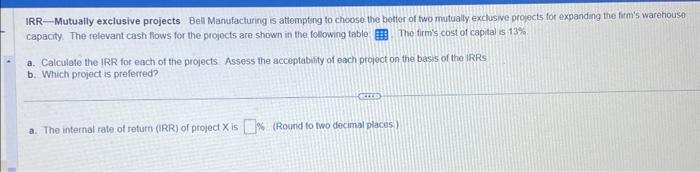

Question: please answer a and b. thank you! IRR-Mutually exclusive projects Bell Manufacturing is attempting to choose the befter of fwo mutually exclusive projects for expanding

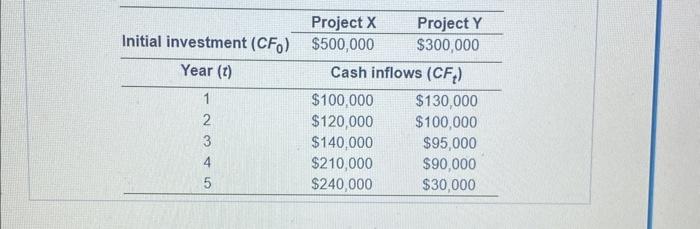

IRR-Mutually exclusive projects Bell Manufacturing is attempting to choose the befter of fwo mutually exclusive projects for expanding the firm's warehouse capacity. The relevant cash flows for the projocts are shown in the following table The firms cost of capital is 13%. a. Calculate the IRR for each of the projects Assess the acceptabitity of each project on the basss of the iRRs b. Which project is preferred? a. The internal rate of return (IRR) of project X is % (Round to two decimal places) \begin{tabular}{ccc} & Project X & Project Y \\ \cline { 2 - 3 } Initial investment (CF0) & $500,000 & $300,000 \\ \hline Year (t) & \multicolumn{2}{c}{ Cash inflows (CFt)} \\ \hline 1 & $100,000 & $130,000 \\ 2 & $120,000 & $100,000 \\ 3 & $140,000 & $95,000 \\ 4 & $210,000 & $90,000 \\ 5 & $240,000 & $30,000 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts