Question: PLEASE ANSWER A AND B WITH FULLY EXPLANATION Consider the problem of measuring the comovement of a particular stocks excess return (Qantas) with the excess

PLEASE ANSWER A AND B WITH FULLY EXPLANATION

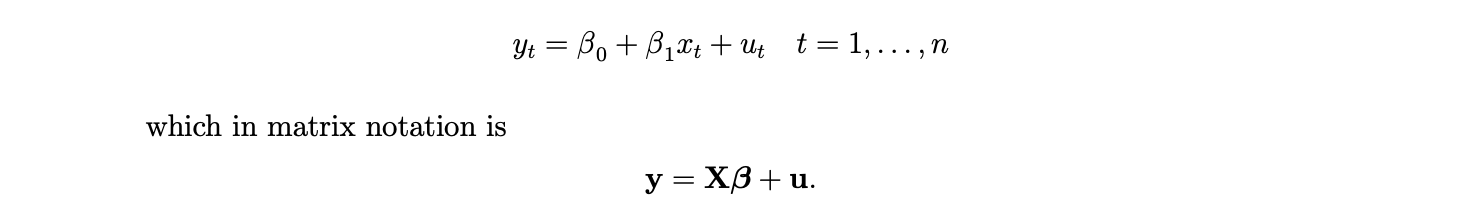

Consider the problem of measuring the comovement of a particular stocks excess return (Qantas) with the excess return of a market portfolio (AllOrds). Excess return is the return minus risk free rate of return (say the 3 month term deposit rate). We denote the stocks excess return byyand the market portfolios excess return byx. We use data on the previousnmonths onyandxand we use the linear model:

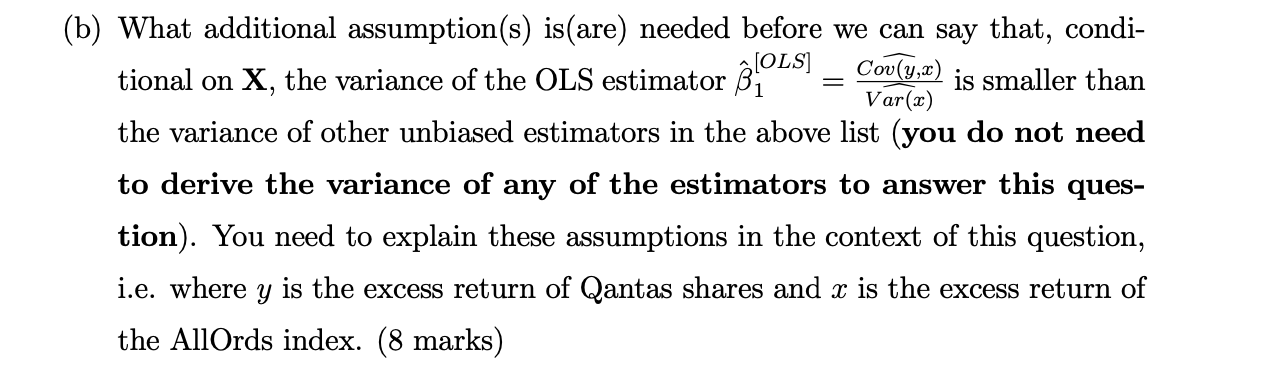

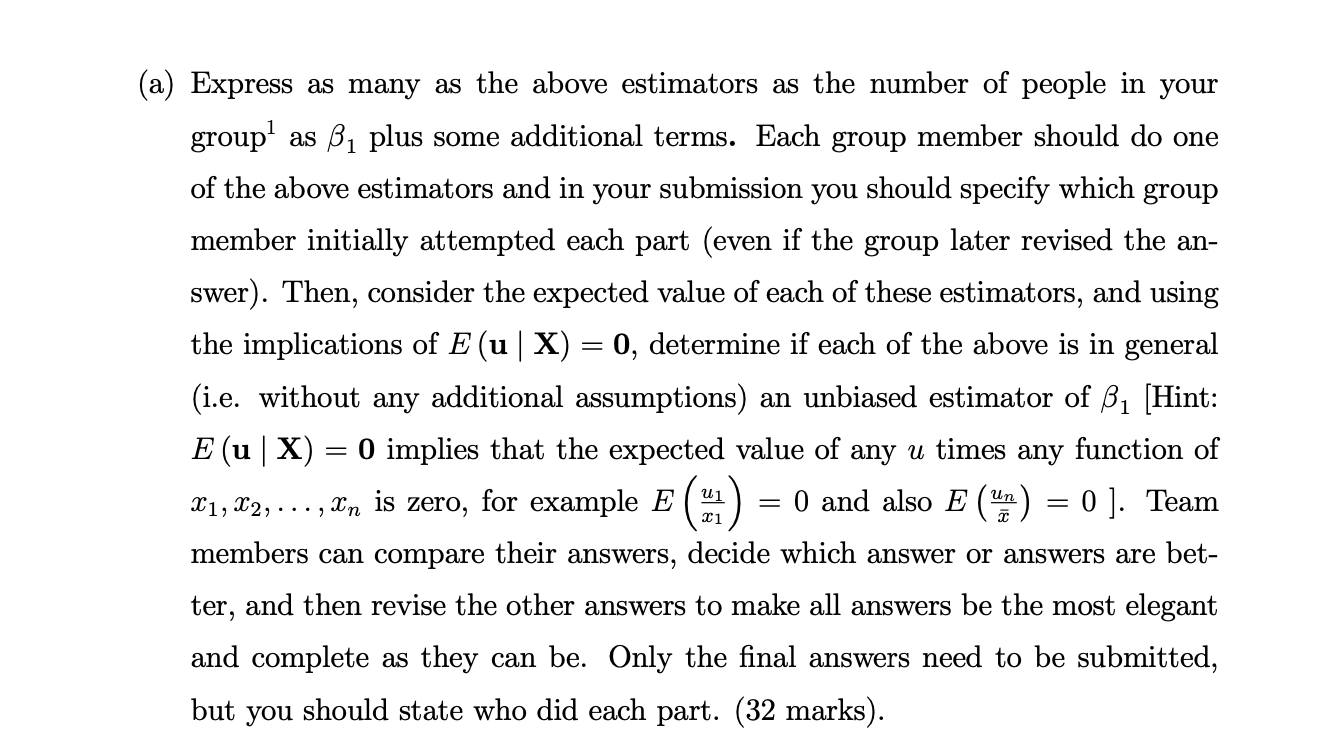

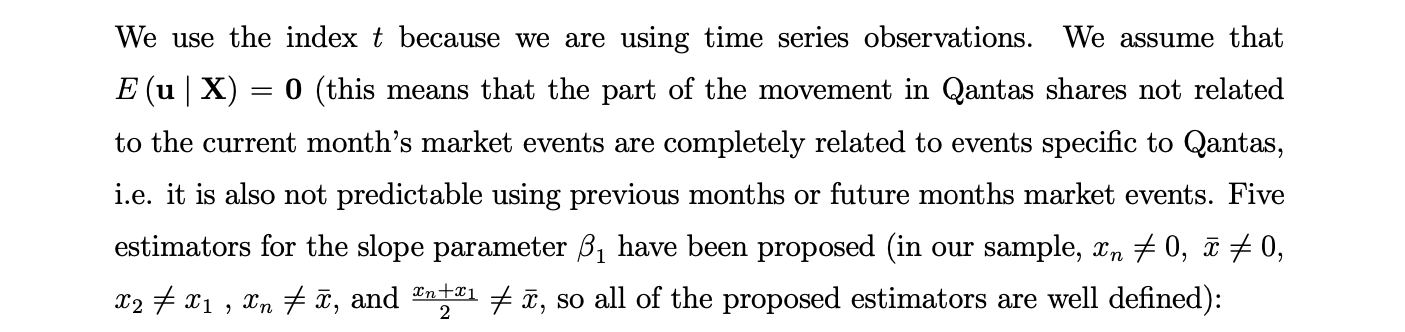

(b) What additional assumption(s) is(are) needed before we can say that, condi- ~ CL A tional on X, the variance of the OLS estimator [3% S] = eggs) is smaller than the variance of other unbiased estimators in the above list (you do not need to derive the variance of any of the estimators to answer this ques- tion). You need to explain these assumptions in the context of this question, i.e. where y is the excess return of Qantas shares and a: is the excess return of the AllOrds index. (8 marks) (a) Express as many as the above estimators as the number of people in your group1 as 51 plus some additional terms. Each group member should do one of the above estimators and in your submission you should specify which group member initially attempted each part (even if the group later revised the an- swer). Then, consider the expected value of each of these estimators, and using the implications of E' (u | X) = 0, determine if each of the above is in general (i.e. without any additional assumptions) an unbiased estimator of 61 [Hintz E (u | X) = 0 implies that the expected value of any at times any function of m1,m2,...,xn is zero, for example E' (\"zi) = 0 and also E (\"F\") = O ]. Team members can compare their answers, decide which answer or answers are bet- ter, and then revise the other answers to make all answers be the most elegant and complete as they can be. Only the nal answers need to be submitted, but you should state who did each part. (32 marks). \fWe use the index t because we are using time series observations. We assume that E(u | X) = 0 (this means that the part of the movement in Qantas shares not related to the current month's market events are completely related to events specific to Qantas, i.e. it is also not predictable using previous months or future months market events. Five estimators for the slope parameter S, have been proposed (in our sample, an # 0, x * 0, x2 1 , n * x, and In 1 / x, so all of the proposed estimators are well defined)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts