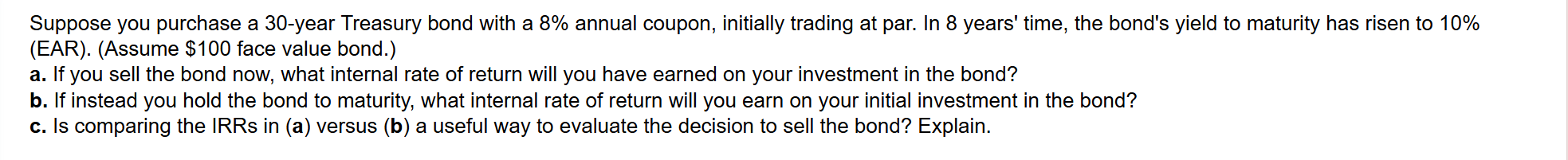

Question: Please answer A , B , and C and show your work: ) I am stuck on the calculations. Suppose you purchase a 3 0

Please answer AB and C and show your work: I am stuck on the calculations. Suppose you purchase a year Treasury bond with a annual coupon, initially trading at par. In years' time, the bond's yield to maturity has risen to

EARAssume $ face value bond.

a If you sell the bond now, what internal rate of return will you have earned on your investment in the bond?

b If instead you hold the bond to maturity, what internal rate of return will you earn on your initial investment in the bond?

c Is comparing the IRRs in a versus b a useful way to evaluate the decision to sell the bond? Explain. an example of how C should be answered is We can't simply compare IRR's. By not selling the bond for its current price of $ we will earn the current market return of on that amount going forward."

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock