Question: please answer question b and c I will give you a like!!!! Question 4 Consider the bond market to be in equilibrium according to our

please answer question b and c I will give you a like!!!!

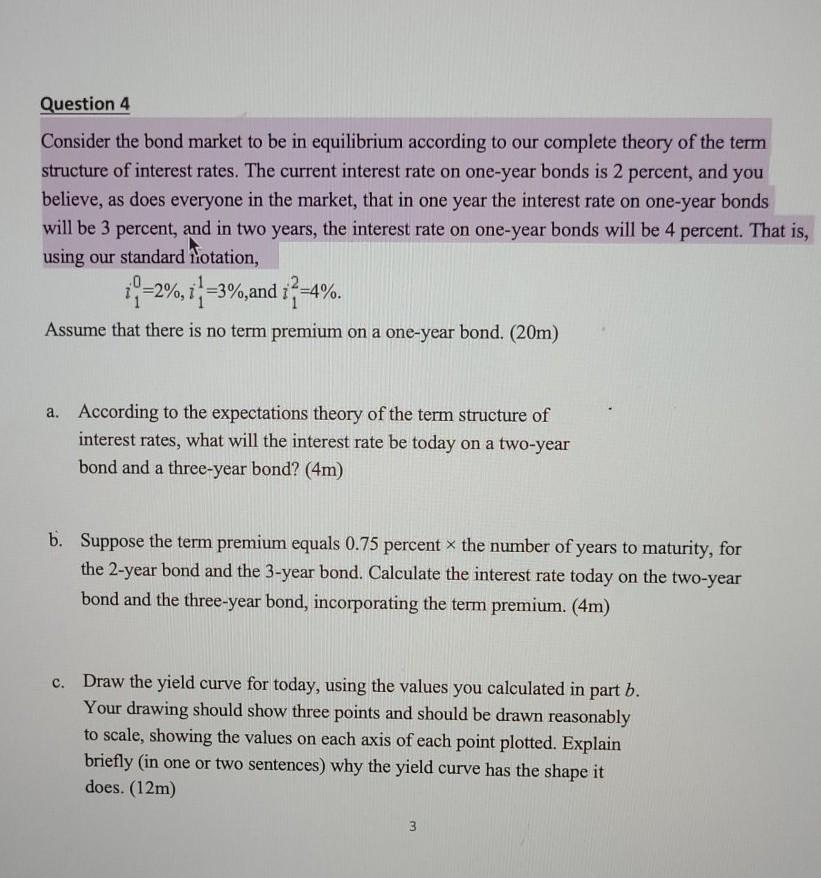

Question 4 Consider the bond market to be in equilibrium according to our complete theory of the term structure of interest rates. The current interest rate on one-year bonds is 2 percent, and you believe, as does everyone in the market, that in one year the interest rate on one-year bonds will be 3 percent, and in two years, the interest rate on one-year bonds will be 4 percent. That is, using our standard Rotation, = 1 Assume that there is no term premium on a one-year bond. (20m) a. According to the expectations theory of the term structure of interest rates, what will the interest rate be today on a two-year bond and a three-year bond? (4m) b. Suppose the term premium equals 0.75 percent x the number of years to maturity, for the 2-year bond and the 3-year bond. Calculate the interest rate today on the two-year bond and the three-year bond, incorporating the term premium. (4m) c. Draw the yield curve for today, using the values you calculated in part b. Your drawing should show three points and should be drawn reasonably to scale, showing the values on each axis of each point plotted. Explain briefly in one or two sentences) why the yield curve has the shape it does. (12m) 3 Question 4 Consider the bond market to be in equilibrium according to our complete theory of the term structure of interest rates. The current interest rate on one-year bonds is 2 percent, and you believe, as does everyone in the market, that in one year the interest rate on one-year bonds will be 3 percent, and in two years, the interest rate on one-year bonds will be 4 percent. That is, using our standard Rotation, = 1 Assume that there is no term premium on a one-year bond. (20m) a. According to the expectations theory of the term structure of interest rates, what will the interest rate be today on a two-year bond and a three-year bond? (4m) b. Suppose the term premium equals 0.75 percent x the number of years to maturity, for the 2-year bond and the 3-year bond. Calculate the interest rate today on the two-year bond and the three-year bond, incorporating the term premium. (4m) c. Draw the yield curve for today, using the values you calculated in part b. Your drawing should show three points and should be drawn reasonably to scale, showing the values on each axis of each point plotted. Explain briefly in one or two sentences) why the yield curve has the shape it does. (12m) 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts