Question: please answer A, B, C and D Problem 5-24 (similar to) Question Help (Loan amortization) Mr. Bill S. Preston, Esq.purchased a new house for $170,000.

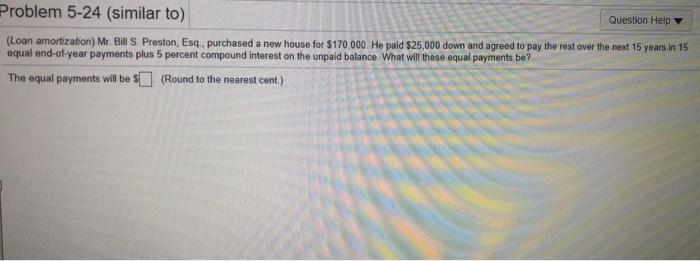

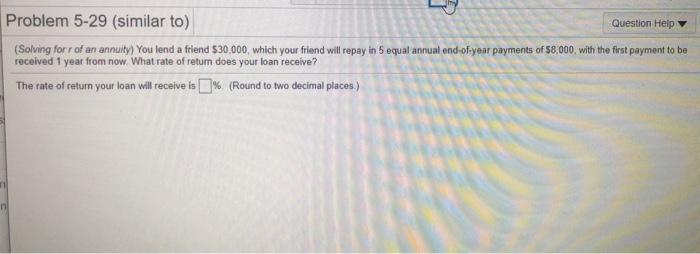

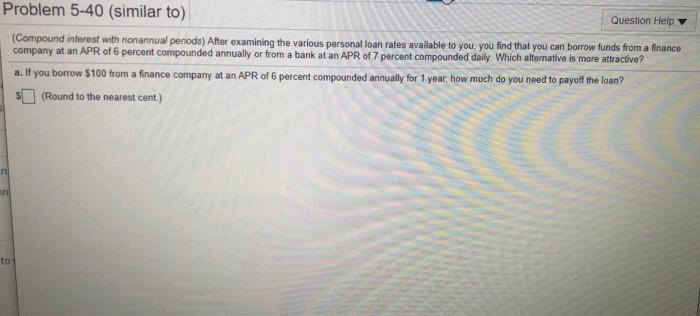

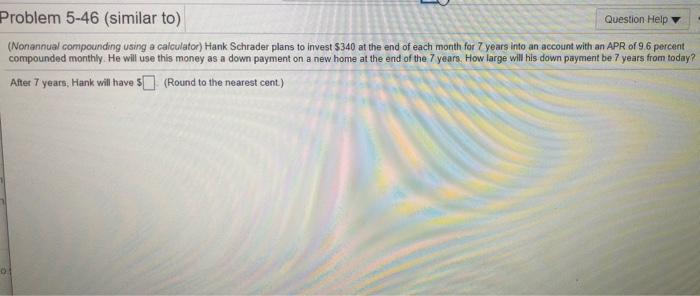

Problem 5-24 (similar to) Question Help (Loan amortization) Mr. Bill S. Preston, Esq.purchased a new house for $170,000. He paid $25,000 down and agreed to pay the rest over the next 15 years in 15 equal end-of-year payments plus 5 percent compound interest on the unpaid balance What will these equal payments be? The equal payments will be $ (Round to the nearest cent) Problem 5-29 (similar to) Question Help (Solving for r of an annuity) You lend a friend $30,000, which your friend will repay in 5 equal annual ond-of-year payments of $8,000, with the first payment to be received 1 year from now. What rate of retum does your loan receive? The rate of return your loan will receive is % (Round to two decimal places.) Problem 5-40 (similar to) Question Help (Compound interest with nonannual periods) After examining the various personal loan rates available to you, you find that you can borrow funds from a finance company at an APR of 6 percent compounded annually or from a bank at an APR of 7 percent compounded daily. Which alternative is more attractive? a. If you borrow $100 from a finance company at APR of 6 percent compounded annually for 1 year, how much do you need to payoff the loan? (Round to the nearest cent.) n on to Problem 5-46 (similar to) Question Help (Nonannual compounding using a calculator) Hank Schrader plans to invest $340 at the end of each month for 7 years into an account with an APR of 9.6 percent compounded monthly. He will use this money as a down payment on a new home at the end of the 7 years. How large will his down payment be 7 years from today? After 7 years, Hank will have $ (Round to the nearest cent.) 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts