Question: please answer a & b, c if possible Direct Application - Objective 2 - deductible pension v. taxable investment Suppose a self-employed taxpayer makes a

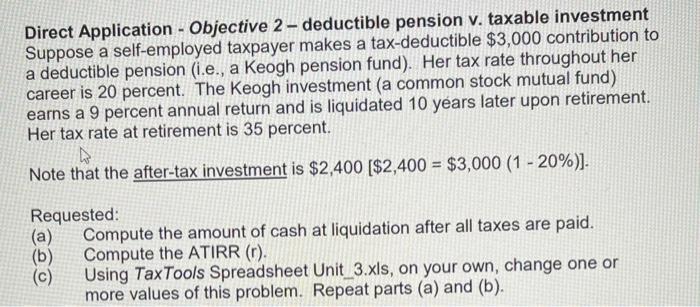

Direct Application - Objective 2 - deductible pension v. taxable investment Suppose a self-employed taxpayer makes a tax-deductible $3,000 contribution to a deductible pension (i.e., a Keogh pension fund). Her tax rate throughout her career is 20 percent. The Keogh investment (a common stock mutual fund) earns a 9 percent annual return and is liquidated 10 years later upon retirement. Her tax rate at retirement is 35 percent. Note that the after-tax investment is $2,400[$2,400=$3,000(120%)]. Requested: (a) Compute the amount of cash at liquidation after all taxes are paid. (b) Compute the ATIRR ( r ). (c) Using TaxTools Spreadsheet Unit_3.xIs, on your own, change one or more values of this problem. Repeat parts (a) and (b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts