Question: Please answer A & B here. ( C can be answered in this link: https://www.chegg.com/homework-help/questions-and-answers/-q81885924?trackid=VjwE4b-Y ) !URGENT! I will upvote if answered ASAP Question 3

Please answer A & B here. ( C can be answered in this link: https://www.chegg.com/homework-help/questions-and-answers/-q81885924?trackid=VjwE4b-Y )

!URGENT! I will upvote if answered ASAP

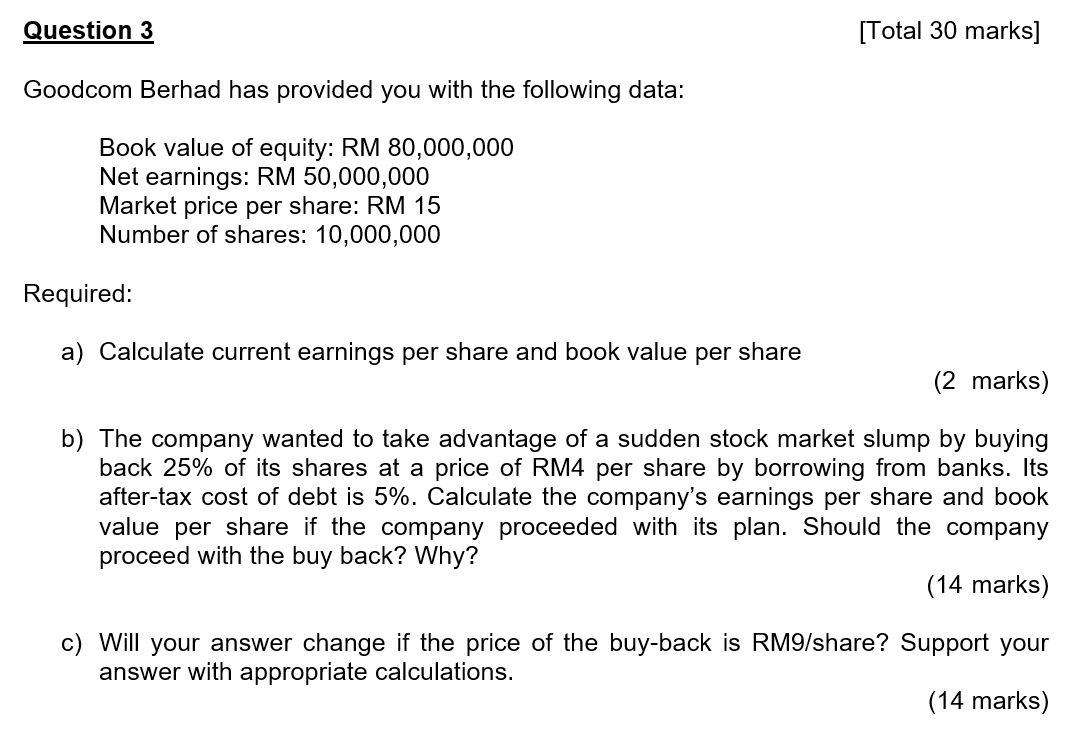

Question 3 [Total 30 marks] Goodcom Berhad has provided you with the following data: Book value of equity: RM 80,000,000 Net earnings: RM 50,000,000 Market price per share: RM 15 Number of shares: 10,000,000 Required: a) Calculate current earnings per share and book value per share (2 marks) b) The company wanted to take advantage of a sudden stock market slump by buying back 25% of its shares at a price of RM4 per share by borrowing from banks. Its after-tax cost of debt is 5%. Calculate the company's earnings per share and book value per share if the company proceeded with its plan. Should the company proceed with the buy back? Why? (14 marks) c) Will your answer change if the price of the buy-back is RM9/share? Support your answer with appropriate calculations. (14 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts