Question: please answer A pension fund manager is considering three mutual funds for investment. The first is stock funds, the second is long-term government bonds and

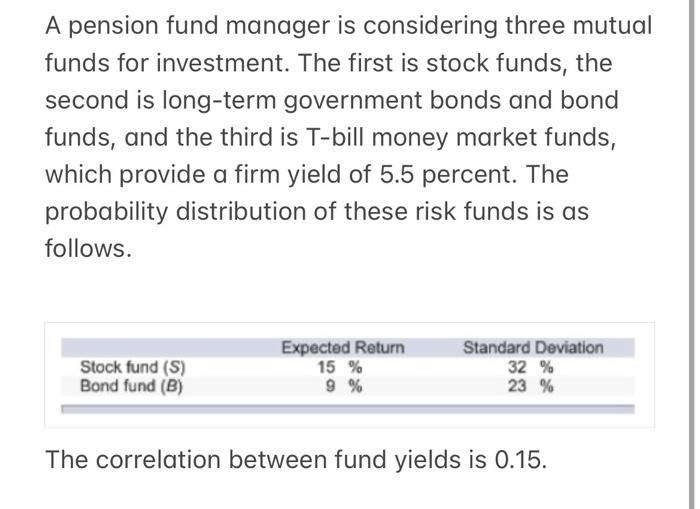

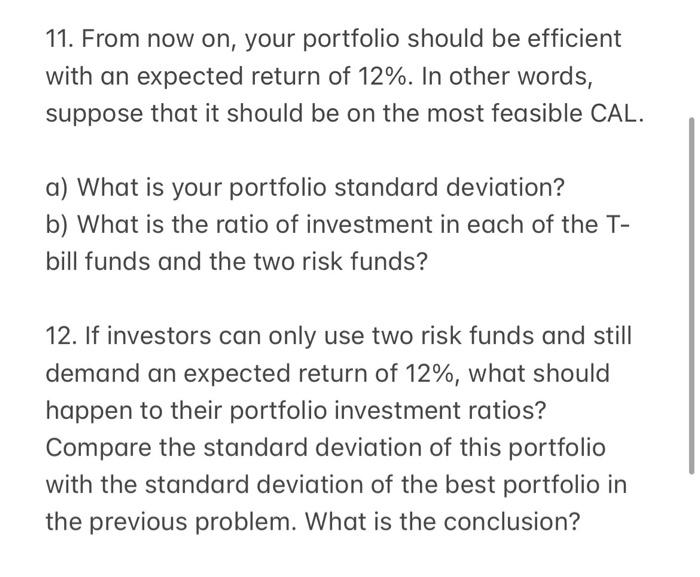

A pension fund manager is considering three mutual funds for investment. The first is stock funds, the second is long-term government bonds and bond funds, and the third is T-bill money market funds, which provide a firm yield of 5.5 percent. The probability distribution of these risk funds is as follows. Stock fund (S) Bond fund (B) Expected Return 15 % 9 % Standard Deviation 32 % 23 % The correlation between fund yields is 0.15. 11. From now on, your portfolio should be efficient with an expected return of 12%. In other words, suppose that it should be on the most feasible CAL. a) What is your portfolio standard deviation? b) What is the ratio of investment in each of the T- bill funds and the two risk funds? 12. If investors can only use two risk funds and still demand an expected return of 12%, what should happen to their portfolio investment ratios? Compare the standard deviation of this portfolio with the standard deviation of the best portfolio in the previous problem. What is the conclusion

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts