Question: Please answer ( a ) through ( g ) . Neighborhood Insurance sells fire insurance policies to local homeowners. The premium is $ 1 2

Please answer a through g

Neighborhood Insurance sells fire insurance policies to local homeowners. The premium is $ the probability of a fire is and in the event of a fire, the insured damages the payout on the policy will be $

Required:

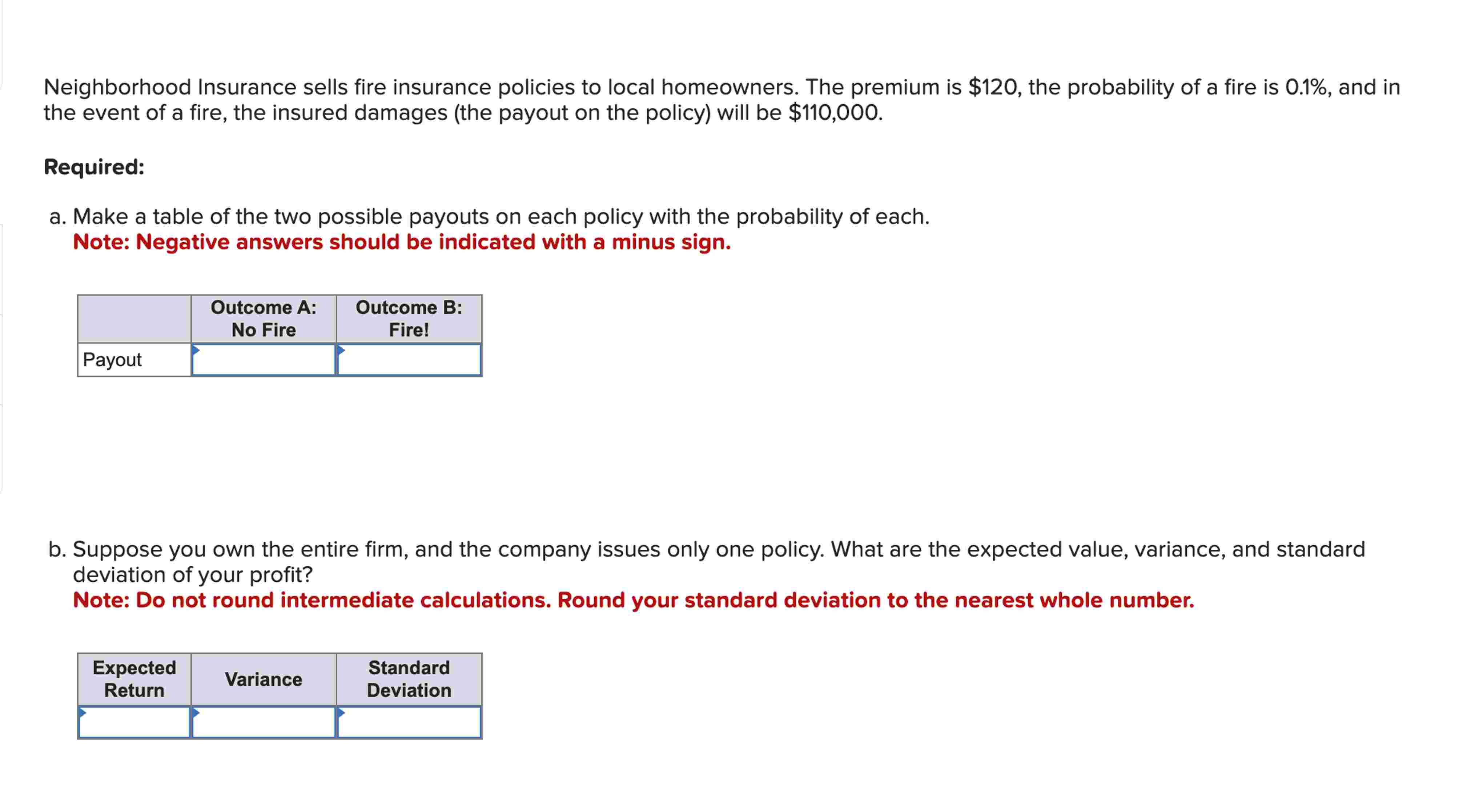

a Make a table of the two possible payouts on each policy with the probability of each.

Note: Negative answers should be indicated with a minus sign.

b Suppose you own the entire firm, and the company issues only one policy. What are the expected value, variance, and standard

deviation of your profit?

Note: Do not round intermediate calculations. Round your standard deviation to the nearest whole number.

c Now suppose your company issues two policies. The risk of fire is independent across the two policies. Make a table of the three

possible payouts along with their associated probabilities.

Note: Negative answers should be indicated with a minus sign. Round your "Probability" answers to decimal places.

d What are the expected value, variance, and standard deviation of your profit?

Note: Do not round intermediate calculations. Round your standard deviation to the nearest whole number.

e Compare your answers to b and d Did risk pooling increase or decrease the variance of your profit?

f Continue to assume the company has issued two policies, but now assume you take on a partner, so that you each own onehalf of

the firm. Make a table of your share of the possible payouts the company may have to make on the two policies, along with their

associated probabilities.

Note: Negative answers should be indicated with a minus sign. Round your "Probability" answers to decimal places.

g What are the expected value and variance of your profit?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock