Question: Please answer a-B omework: Chapter 10 Homework ore: 0 of 1 pt 70f 9 (2 complete) Hw Score: 11.11%, 1 10-16 (similar to) Question Help

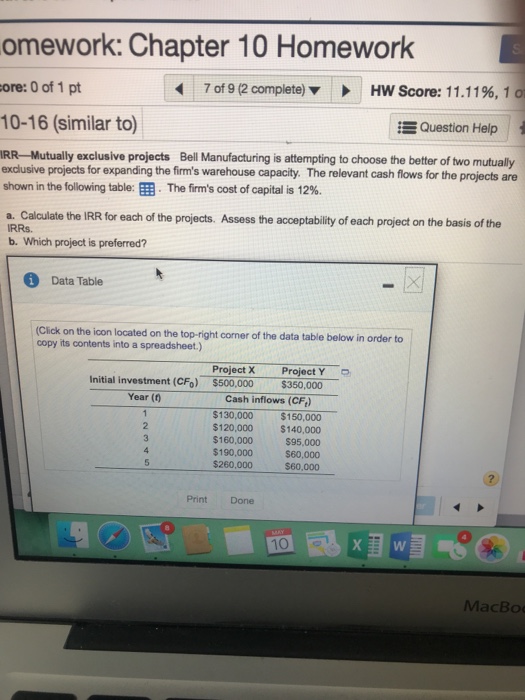

omework: Chapter 10 Homework ore: 0 of 1 pt 70f 9 (2 complete) Hw Score: 11.11%, 1 10-16 (similar to) Question Help IRR-Mutually exclusive projects Bell Manufacturing is attempting to choose the better of two mutually exclusive projects for expanding the firm's warehouse capacity. The relevant cash flows for the projects are shown in the following table: The firm's cost of capital is 12%. a. Calculate the IRR for each of the projects. Assess the acceptability of each project on the basis of the IRRS. b. Which project is preferred? Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Project XProject Y $500,000 $350,000 Initial investment (CFo) Year ( Cash inflows (CFt) $130,000 $150,000 120,000 $140,000 $160,000$60,000 $190,000 $260,000 $95,000 $60,000 Print Done MacBo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts