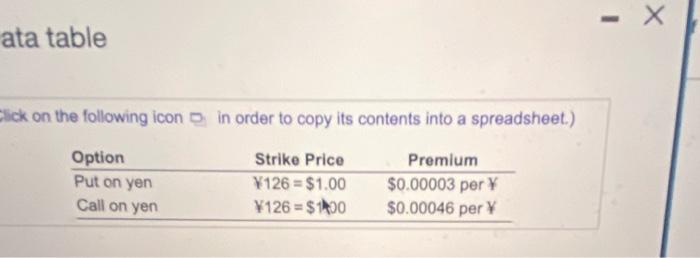

Question: please answer a,b,and c with all steps shown ata table Wick on the following icon in order to copy its contents into a spreadsheet.) Cachita

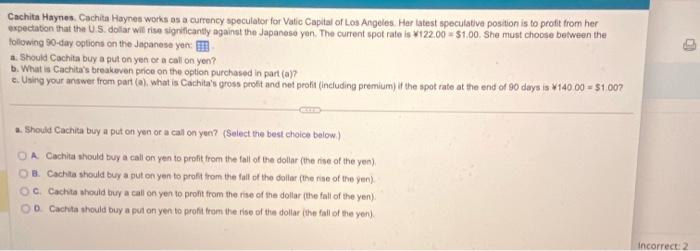

ata table Wick on the following icon in order to copy its contents into a spreadsheet.) Cachita Haynes. Cachita Haynes works as a currency speculator for Vatic Capital of Los Angeles. Her iatest speculative position is to profit trom her expectaton that the U.5. doliar wil rise signicantly againd the Japaneso yen. The current spot rate is yi.22.00 = $1.00. She must choose between the foligwing 90-day opticns on the Japanese yon: a. Should Cachita buy a put on yen or a call on yen? b. What is Cachita's breakeven prioe on the option purchased in part (a)? e. Using your answer from part (a), what is Cachita's gross probt and net profit (including premium) if the apot rate at the end of 90 days is y 140 o0 = 51.00 ? a. Should Cachita buy a put on yen of a call on yen? (Select the best choice below.) A. Cachita should buy a call on yen to profit from the fall of the dollar (the nise of the yen). a. Cachita should buy a put onyen to profit trom the fall of the dollar (the rise of the yen). c. Cachta should buy a call on yen to profit from the rise of the dollar (the fall of the yen). 0. Cachta thould buy a pui on yen to profit from the rise of the dollar (the fall of the yen)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts