Question: please answer (a)(b)(c) step by step! 3. Consider a market with the following three bonds. The first bond is a one-year zero 987 - 20

please answer (a)(b)(c) step by step!

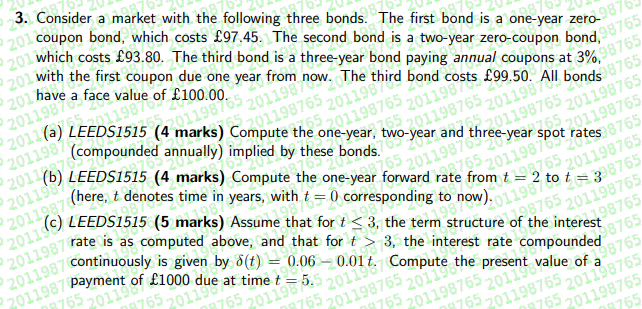

3. Consider a market with the following three bonds. The first bond is a one-year zero 987 - 20 coupon bond, which costs 97.45. The second bond is a two-year zero-coupon bond,08765 -20 which costs 93.80. The third bond is a three-year bond paying annual coupons at 3%98765 20 with the first coupon due one year from 20have a face value of 100.00. 201198765 2011987 1198 01195755 01198765 201190 hird 201 (a) LEEDS1515 (4 marks) Compute the one112870320770 costs 99.50. All bonds 3765 201198 how. The third bond two.01198702201.19870 65 0765 e to t = 33765 2011981 2011 2011982 2011237 -2011 2011987 2011987 (compounded annually) implied by these bonds. LEEDS1515 (4 marks) Compute the one-year forward rate from t2765. (here, t denotes time in years, with t = 0 corresponding to now). (C) LEEDS1515 (5 marks) Assume that for t

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts