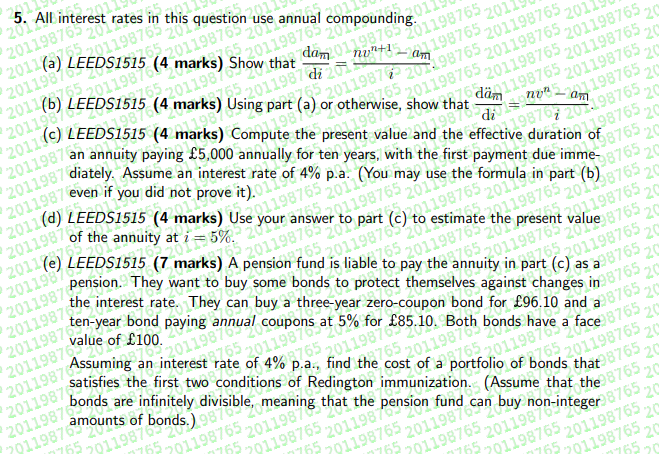

Question: please answer (a)(b)(c)(d)(e) step by step! 5. this question use use annual compounding, that (4 marks) 20119876524 2011981 11957 4,01198705 2011987 2011957 2011987 20: All

please answer (a)(b)(c)(d)(e) step by step!

5. this question use use annual compounding, that (4 marks) 20119876524 2011981 11957 4,01198705 2011987 2011957 2011987 20: All interest rates in 20119870 201 (a) LEEDS7533 20119870 201 (6) LEEDS1515 (4 marks) Using part (2) 201198 207.98763201198765 dam 01298765 3:1198765201 Si201198 din 198703201198702 2011 or otherwis 201198765201198765 201198765. 120 show that dam 198765 20120_119870224 of 4% 19871202.9870226 201 (d) LEEDS1515 (4 marks) Use your 87552 W876520 20 answer 1198765 answer to part (c) 1198705.2013 20 20 0119876320087 te 20 aneb.20119870 2011987alue of 100. 20 20 220 48765 98765 th198765 20128765 to 20119870 201198765 201198765 di 2011 (C) LEEDS1515 (4 marks) Compute the present value and the effective duration of an annuity paying 5,000 annually for ten years, with the first payment due imme- 201198 diately. Assume an interest rate 201198 even if you did not prove it). p.a. (You may use the formula in part (b) of the annuity at i = 5%. Present Valle 9876 201 (E) LEEDS1515 (7 marks) A pension fund is liable to pay the annuity in part (c) as a 876520 pension. They want to buy some bonds to protect themselves against changes in 8765 the interest rate. They can buy a three-year zero-coupon bond for 96.10 and 201198719-year bond paying annual coupons at 5% for 85.10. Both bonds have a face 876920 Assuming an interest rate of 4% p.a., find the cost of a portfolio of bonds that 876220 satisfies the first two conditions of Redington immunization. Assume that the 370220 bonds are infinitely 2011957 2011987 2011987, 2011987 2011987 2011987 20119876 2011987 201198711 2011987, 2011987 20 2011987 amounts of bones y divisible, meaning that the 201198 pension fund can buy non-integer 876320 201198765 15520 155701198 a 3765 155701198765201198718 755 301198765 24 201.198765 755 701198765 2011987 sa 759 201198765 20119870 1755 701198765 201198765 26 759 5. this question use use annual compounding, that (4 marks) 20119876524 2011981 11957 4,01198705 2011987 2011957 2011987 20: All interest rates in 20119870 201 (a) LEEDS7533 20119870 201 (6) LEEDS1515 (4 marks) Using part (2) 201198 207.98763201198765 dam 01298765 3:1198765201 Si201198 din 198703201198702 2011 or otherwis 201198765201198765 201198765. 120 show that dam 198765 20120_119870224 of 4% 19871202.9870226 201 (d) LEEDS1515 (4 marks) Use your 87552 W876520 20 answer 1198765 answer to part (c) 1198705.2013 20 20 0119876320087 te 20 aneb.20119870 2011987alue of 100. 20 20 220 48765 98765 th198765 20128765 to 20119870 201198765 201198765 di 2011 (C) LEEDS1515 (4 marks) Compute the present value and the effective duration of an annuity paying 5,000 annually for ten years, with the first payment due imme- 201198 diately. Assume an interest rate 201198 even if you did not prove it). p.a. (You may use the formula in part (b) of the annuity at i = 5%. Present Valle 9876 201 (E) LEEDS1515 (7 marks) A pension fund is liable to pay the annuity in part (c) as a 876520 pension. They want to buy some bonds to protect themselves against changes in 8765 the interest rate. They can buy a three-year zero-coupon bond for 96.10 and 201198719-year bond paying annual coupons at 5% for 85.10. Both bonds have a face 876920 Assuming an interest rate of 4% p.a., find the cost of a portfolio of bonds that 876220 satisfies the first two conditions of Redington immunization. Assume that the 370220 bonds are infinitely 2011957 2011987 2011987, 2011987 2011987 2011987 20119876 2011987 201198711 2011987, 2011987 20 2011987 amounts of bones y divisible, meaning that the 201198 pension fund can buy non-integer 876320 201198765 15520 155701198 a 3765 155701198765201198718 755 301198765 24 201.198765 755 701198765 2011987 sa 759 201198765 20119870 1755 701198765 201198765 26 759

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts