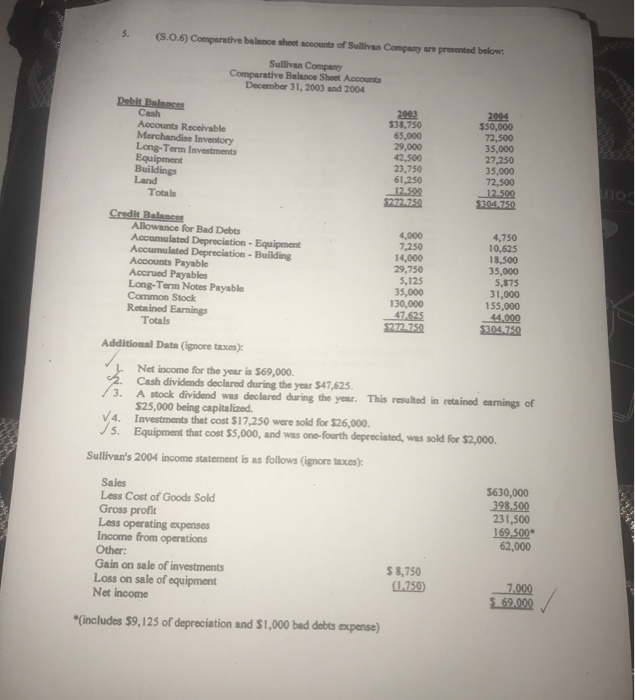

Question: please answer above the question. thanks 5. (S.O.6) Comparative balance shoet accounts of Sullivan Company are presented below Sullivan Company Comparative Balance Shoet Accounts December

please answer above the question. thanks

please answer above the question. thanks 5. (S.O.6) Comparative balance shoet accounts of Sullivan Company are presented below Sullivan Company Comparative Balance Shoet Accounts December 31, 2003 and 2004 Debit Balances Cash Accounts Receivable Merchandise Inventory Long-Term Investments Equipment Buildings Land Totals 2004 $50,000 72,500 35,000 27,250 35,000 72,500 12.500 $304.750 2003 $38,750 65,000 29,000 42,500 23,750 61,250 12.500 $272.750 Credit Balamces Allowance for Bad Debts Accumulated Depreciation- Equipment Accumulated Depreciation- Building Accounts Payable Accrued Payables Long-Term Notes Payable Common Stock Retained Earnings Totals 4,000 7,250 14,000 29,750 5,125 35,000 4,750 10,625 18,500 35,000 5,875 31,000 155,000 44.000 $304.750 130,000 47.625 $272.750 Additional Data (ignore taxes) Net income for the year is $69,000. Cash dividends declared during the year $47,625 A stock dividend was declared during the year. This resulted in retained earnings of $25,000 being capitalized V4. Investments that cost $17,250 were sold for $26,000. Equipment that cost $5,000, and was one-fourth depreciated, 3 was sold for $2,000. Sullivan's 2004 income statement is as follows (ignore taxes): Sales Less Cost of Goods Sold Gross profit Less operating expenses Income from operations Other: Gain on sale of investments Loss on sale of equipment Net income $630,000 398.500 231,500 169,500 62,000 $ 8,750 1.750 7,000 $ 69,000 Cincludes $9,125 of depreciation and $1,000 bad debts expense) Cash flows from Operating Activities Net Income Adjustments to reconcile net Income to net cash provided by Operating Activities Net Cash provided (used) by operating activities Cash flows from Investing Activities Net Cash provided (used) by investing activities Cash flows from Financing Activities Net Cash provided (used) by Financing Activities Net Increase (decrease) in cash Cash, Beginning Cash, Ending

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts