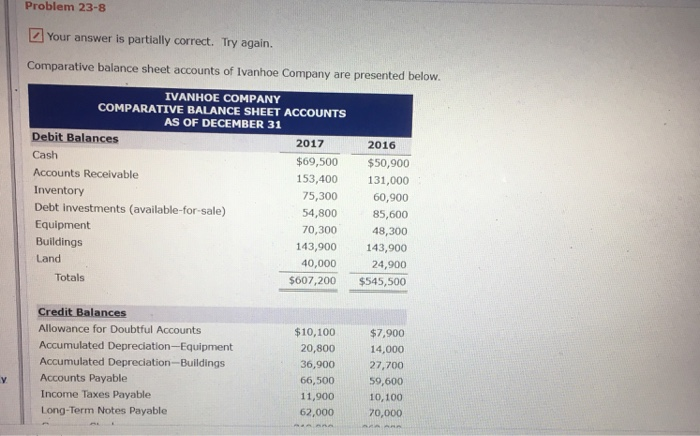

Question: Please fix the incorrect answers please. Problem 23-8 Your answer is partially correct. Try again. Comparative balance sheet accounts of Ivanhoe Company are presented below.

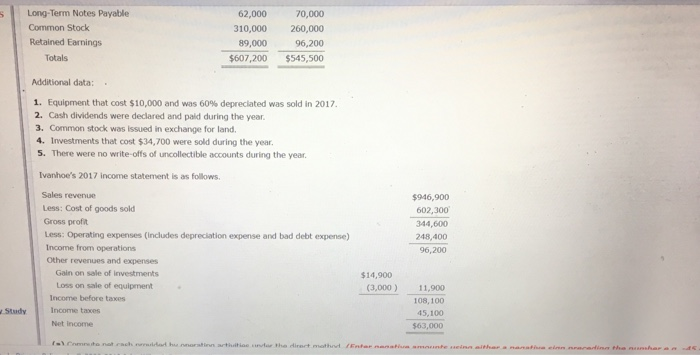

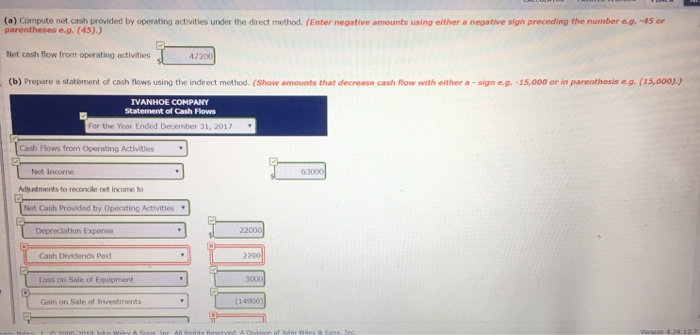

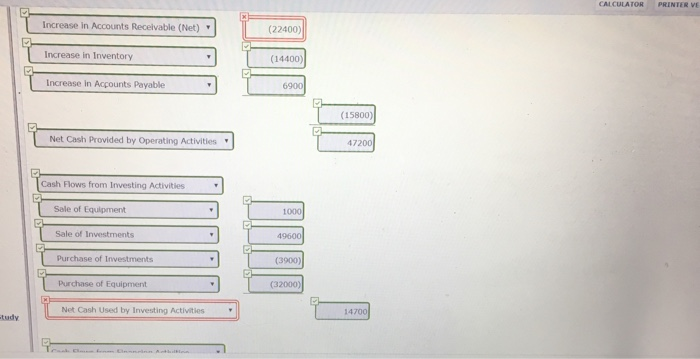

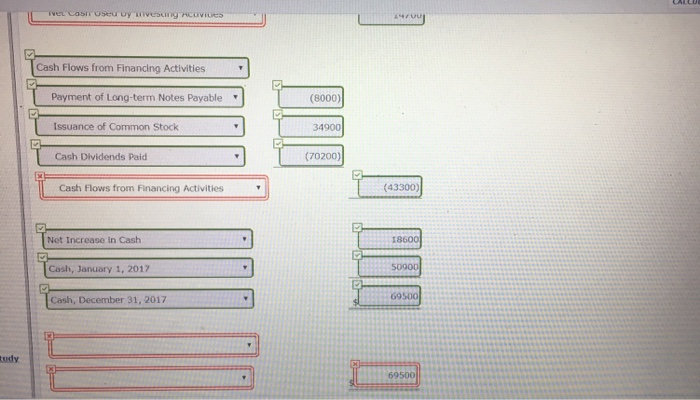

Problem 23-8 Your answer is partially correct. Try again. Comparative balance sheet accounts of Ivanhoe Company are presented below. IVANHOE COMPANY COMPARATIVE BALANCE SHEET ACCOUNTSs AS OF DECEMBER 31 Debit Balances Cash Accounts Receivable Inventory Debt investments (available-for-sale) Equipment Buildings Land 2017 2016 $69,500 $50,900 153,400 131,000 75,300 60,900 85,600 0,300 48,300 143,900 143,900 24,900 $607,200 $545,500 54,800 40,000 Totals Credit Balances Allowance for Doubtful Accounts Accumulated Depreciation-Equipment Accumulated Depreciation-Buildings Accounts Payable Income Taxes Payable Long-Term Notes Payable $10,100 $7,900 20,800 14,000 36,900 27,700 59,600 11,900 10,100 70,000 66,500 62,000 (a) Compute net cash provided by operating activities under the direct method. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Net cash flow from operating activities4720 (b) Prepare a statment of cash flows using the indirect method. (Show amounts that decrease cash flow with either a -sign e.g. -15,000 or in parenthesis e-g. (15,000).) IVANHOE COMPANY Statement of Cash Hows or the Year Ended December 31, 2017 Cash Flows from Operating Activities Net Income 63000 Adjntments to reconcile net Income to Not Cash Provided by Operating Activities Expense Cash Dividends Paid Loss on Sale of Equipment Gain on Sale of (14900 CALCULATOR PRINTER VE Increase in Accounts Receivable (Net) . (22400) Increase in Inventory (14400) Increase in Accounts Payable 6900 (15800) Net Cash Provided by Operating Activities 47200 Cash Flows from Investing Activities Sale of Equipment Sale of Investments Purchase of Investments 1000 49600 (3900) Purchase of Equipment (32000) Net Cash Used by Investing Activities 1470 tudy Cash Flows from Financing Activities Payment of Long-term Notes Payable (8000) Issuance of Common Stock 34900 Cash Dividends Paid (70200) Cash Flows from Financing Activities (43300) Net Increase in Cash 18600 Cash, January 1, 2017 Cash, December 31, 2017 69500 udy 69500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts