Question: please answer a~c with steps and process Thank you You are deciding between two mutually exclusive investment opportunities. Both require the same initial investment of

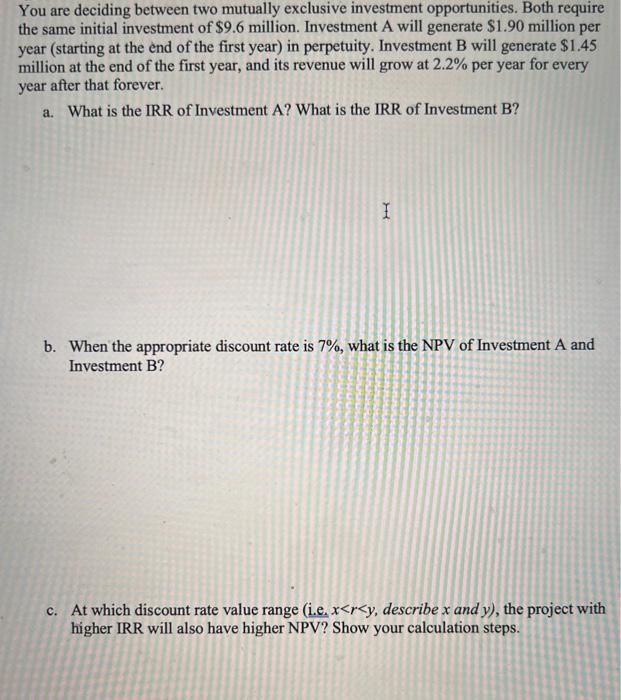

You are deciding between two mutually exclusive investment opportunities. Both require the same initial investment of $9.6 million. Investment A will generate $1.90 million per year (starting at the end of the first year) in perpetuity. Investment B will generate $1.45 million at the end of the first year, and its revenue will grow at 2.2% per year for every year after that forever. a. What is the IRR of Investment A? What is the IRR of Investment B? I b. When the appropriate discount rate is 7%, what is the NPV of Investment A and Investment B? c. At which discount rate value range (i.e. x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts