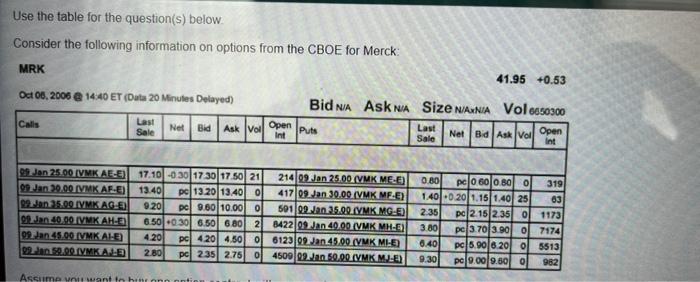

Question: Please answer accurately for an upvote! Use the table for the question(s) below. Consider the following information on options from the CBOE for Merck: MRK

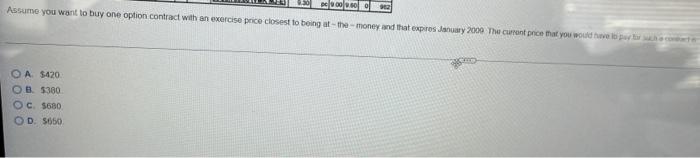

Use the table for the question(s) below. Consider the following information on options from the CBOE for Merck: MRK 41.95 +0.53 Oct 06, 2006 @ 14:40 ET (Duta 20 Minutes Delayed) Bid NA Ask NA Size N/AxNIA Vol 0650300 Calls Last Sale Net Bid Ask Vall Open Int Puts Last Sale NetBdAsk Vol Open 29 Jan 25.00 IVMK AEE) 09 Jan 29.00. IVMK AFE) 29 Jan 25.00 TVMK AGE) 29 Jan 40.90 TVMK AH.) 09. Jan 45.00 IVMK AIE 22 52.00. IVMKAJE 17.10 -0 30 1730 17.50 21 13.40 pc 13.20 13.40 ol 9.20 pel 9.60 10.000 6.500 30 6.50 6.80 2 420 pcl 420 4.50 0 2.80 pc 2.35 2.75 0 21409 Jan 25.00 (VMK MELE) 417|09. Jan 30.09.(VMK MEE) 501 02 Jan 35.00. (YMK MGE 8422 09 Jan 4000 (VMK MH-E) 6123/09 Jan 45.00. (VMK MI-E) 4509 29 Jan 50.00 (VMK MJE) 0.80 pclo 60 0.80 0 3191 1.40.020 1.15 1.40 25 63 2.35 pc 2.15 2.35 0 1173 3.80 pc 3.70 3.90 07174 0.40 pc 5.906.20 5513 9.30 pc 9.00 9.500 982 olo Assume it want in hitronnontin 0.00 Assume you want to buy one option contract with an exercise price closest to being at-the-money and that expres January 2009 The current pnce that you would have to put OA $420 OB 5380 OCS680 OD 5650

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts