Question: The answer is A. Can you explain why this particular contract is in the money and the others are not, or how I can figure

The answer is A. Can you explain why this particular contract is in the money and the others are not, or how I can figure out which contract is the most valuable. Thanks

The answer is A. Can you explain why this particular contract is in the money and the others are not, or how I can figure out which contract is the most valuable. Thanks

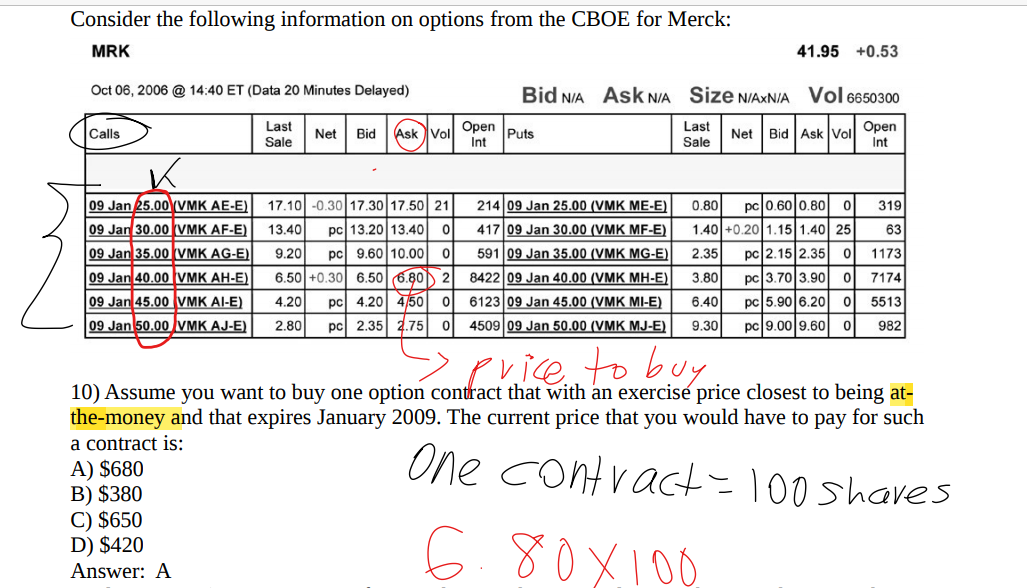

Consider the following information on options from the CBOE for Merck: MRK 41.95 +0.53 Oct 06, 2006 @ 14:40 ET (Data 20 Minutes Delayed) Bid NIA Ask N/A Size N/AxN/A Vol 6650300 Calls Last Sale Net Bid Ask Vol Open Int Puts Last Sale Net Open Bid Ask Voll Int K 319 63 09 Jan 25.00 VMK AE-E) 09 Jan 30.00 VMK AF-E) 09 Jan 35.00 VMK AG-E) 09 Jan 40.00 VMK AH-E) 09 Jan 45.00 VMK AI-E) 09 Jan 50.00 VMK AJ-E) 17.10] -0.30 17.30 17.50 21 13.40 pc 13.20 13.40 0 9.20 pc 9.60 10.00 0 6.50 +0.30 6.50 6.80) 2 4.20 pc 4.20 4/50 0 2.80 PC 2.35 4.75 0 214 09 Jan 25.00 (VMK ME-E) 417 09 Jan 30.00 (VMK MF-E) 591 09 Jan 35.00 (VMK MG-E) 8422 09 Jan 40.00 (VMK MH-E) 6123 09 Jan 45.00 (VMK MI-E) 4509 09 Jan 50.00 (VMK MJ-E) 0.80 pc 10.600.800 1.40 +0.20 1.15 1.40 25 2.35 pc 2.15 2.35 0 3.80 pc 3.70 3.90 0 6.40 pc 5.906.2010 9.30 pc 9.00 9.60 0 1173 7174 5513 982 > price to buy 10) Assume you want to buy one option contract that with an exercise price closest to being at- the-money and that expires January 2009. The current price that you would have to pay for such a contract is: A) $680 B) $380 C) $650 D) $420 Answer: A One contract=100 shares 6.808.100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts