Question: Please Answer A~D with steps and reasons why True or false? If it is true, please justify why it is true statement. If it is

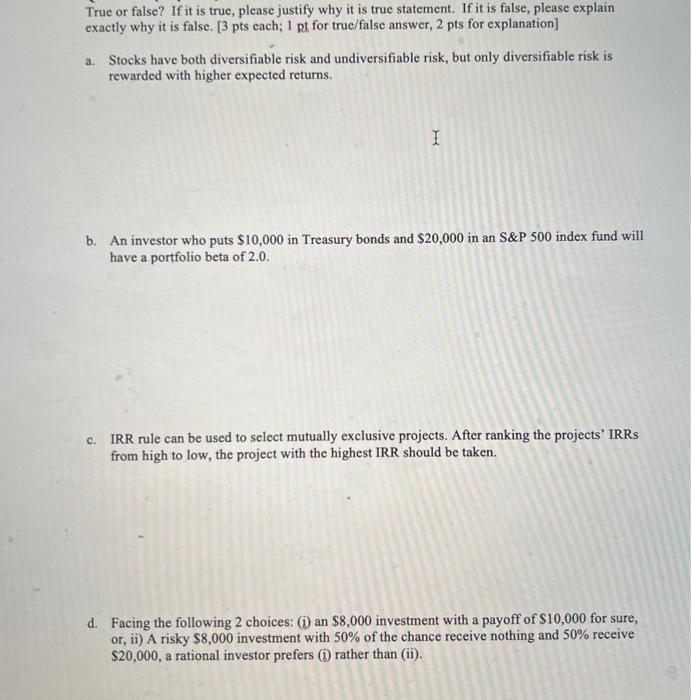

True or false? If it is true, please justify why it is true statement. If it is false, please explain exactly why it is false. [3 pts each; 1 pt for true/false answer, 2 pts for explanation] a. Stocks have both diversifiable risk and undiversifiable risk, but only diversifiable risk is rewarded with higher expected returns. I b. An investor who puts $10,000 in Treasury bonds and $20,000 in an S&P 500 index fund will have a portfolio beta of 2.0. c. IRR rule can be used to select mutually exclusive projects. After ranking the projects' IRRS from high to low, the project with the highest IRR should be taken. d. Facing the following 2 choices: (i) an $8,000 investment with a payoff of $10,000 for sure, or, ii) A risky $8,000 investment with 50% of the chance receive nothing and 50% receive $20,000, a rational investor prefers (i) rather than (ii)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts