Question: True or false? If it is true, please justify why it is a true statement. If it is false, please explain exactly why it is

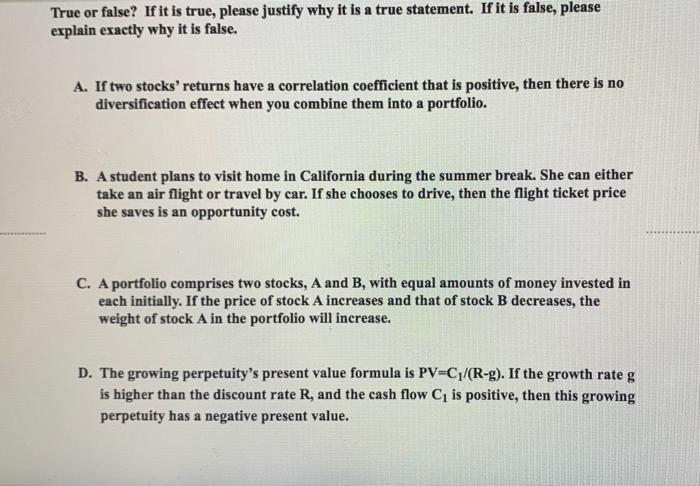

True or false? If it is true, please justify why it is a true statement. If it is false, please explain exactly why it is false. A. If two stocks' returns have a correlation coefficient that is positive, then there is no diversification effect when you combine them into a portfolio. B. A student plans to visit home in California during the summer break. She can either take an air flight or travel by car. If she chooses to drive, then the flight ticket price she saves is an opportunity cost. C. A portfolio comprises two stocks, A and B, with equal amounts of money invested in each initially. If the price of stock A increases and that of stock B decreases, the weight of stock A in the portfolio will increase. D. The growing perpetuity's present value formula is PV=C1/(R-g). If the growth rate g is higher than the discount rate R, and the cash flow C1 is positive, then this growing perpetuity has a negative present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts