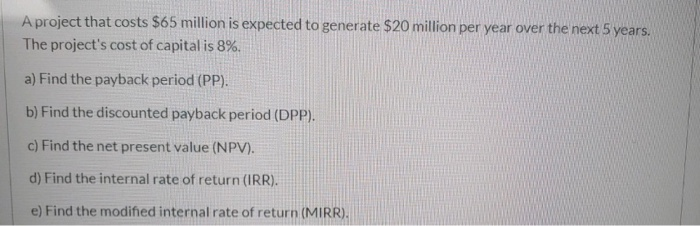

Question: please answer a-e A project that costs $65 million is expected to generate $20 million per year over the next 5 years. The project's cost

A project that costs $65 million is expected to generate $20 million per year over the next 5 years. The project's cost of capital is 8%. a) Find the payback period (PP). b) Find the discounted payback period (DPP). c) Find the net present value (NPV). d) Find the internal rate of return (IRR). e) Find the modified internal rate of return (MIRR)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts