Question: Please answer A-F thank you so much Blingham Packaging is considering expanding its production capacty by purchasing a new machine, the XC-750. The cost of

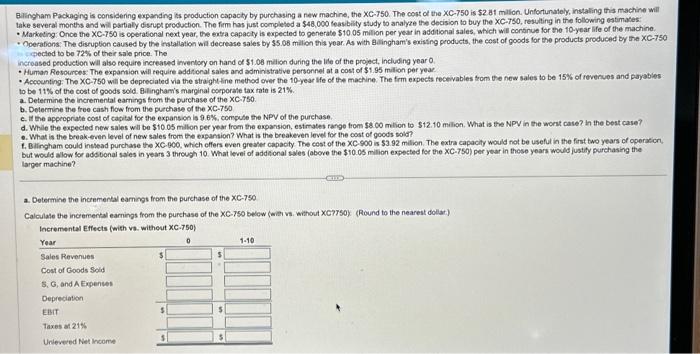

Blingham Packaging is considering expanding its production capacty by purchasing a new machine, the XC-750. The cost of the XC-750 is 52 at milion. Unfortunately, instaling this machine will take several months and will partaly disupt production. The fim has just oompleted a $48,000 feasbility study to analyze the decision to buy the XC-750, resulting in the following estimates: - Marketing. Once the XC-750 is operational next year, the extra cepacily is expected to generate $10.05 million per year in additional sales, which will conanue for the 10-year life of the machine. - Operafions: The discuption caused by the inatallation wil decrease sales by $5.08 milion this yoar. As with adingham's exising products, the cest of goods for the products produced by the xC-750 rected to be 72% of their sale price. The incroased peoduction wil alse require increased invertory on hand of $1.08 malion during the lile of the project, including year 0 - Human Resources: The expantion will require additonal sales and administrative personnel at a cost of $1.95 milion per year - Aceounting: The XC-750 will be depreciated via the straight-line method over the 10 -year Hfe of the machine. The frm expects receivables trom the new sales to be 15% of reveruves and payables to be 11% of the cost of goods sold. Bilingham's marginal coporate tax tate is 21%. a. Determine the incremental earnings teom the purchase of the XC750. b. Determine the tree cash fow from the purchase of the XC-7So c. It the approprate cost of capital for the expansion is 966N, compute the NPV of the purchase. d. While the expected new sales will be $10.05 millon per year from the expansion, estmates range from 5800 milion to $12.10 milion. What is the NPV in the worit case? in the best case? 6. What is the beeak-even level of new sales from the expantion? What is the breakeven level for the cost of goods sold? 1. Baingham could insead purchase the XC.900, which effers even greater capacty the cest of the XC900 in 53.92 milion. The extra capacity would not be usefur in the first two years of operation but would allow sor adsbonal saies in years 3 through 10 . What levei of addifional swes (above the $10.05 milion expected for the xC-7So) per year in those years would justify purchasing the larger machine? a. Determine the incremental eamings from the purchase of the C750 Calculase the incremental eamings from the purchase of the XC-750 below (wat ve. whthout XC7rs0) (Round to the neareit dollat)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts