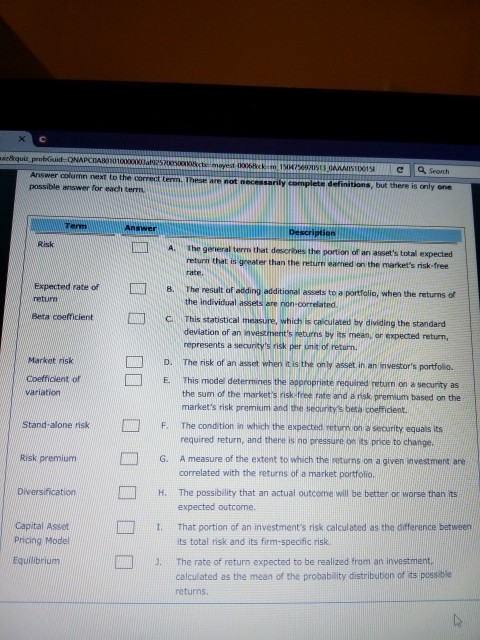

Question: please answer A-J completely and correctly. thanks! Answer column next to the correct term. These are not necessarily possible answer for each terrn complete definitions,

please answer A-J completely and correctly.

thanks!

Answer column next to the correct term. These are not necessarily possible answer for each terrn complete definitions, but there is only one Risk 1 A. 'he general term that describes the portion of arasset's total expected return that is greater than the return earmed on the market's risk-free rate Expected rate of retum 8. The result of adding additional assets to a portfolio, N hen the mums the individual assets are non-oorrelated Beta coefficient c This statistical mesure, which s alculated bv dividing the standard is statistical measure, which is calculated by dividing the standard deviation of an investment's returns by its mean, or expected returr, represents a security's risk per unit of return. The risk of an asset when it is the only asset in an investor's Market risk coefficient of variation D. portfolio. E. This mode determines the appropriote required return on a security as the sum of the market's risk-free rate and a ris premium based on the market's risk premium and the security's bera coefficlent. Stand-alone risk F. The condition in which the expected return onasearity equals its required return, and there is no pressure on its phice to change Risk premium Ameasure of the extent to which tereturns on a given investment are correlated with the returns of a market portfolio The possibility that an actual outcorne will be better or worse than its expected outcome G. Diversification H. Capital Asset Pricing Model 1 That portion ofan investment's risk calculated as the difference between its total risk and its firm-specific risk. The rate of return expected to be realized from an investment. calculated as the mean of the probability distribubion of its possible returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts