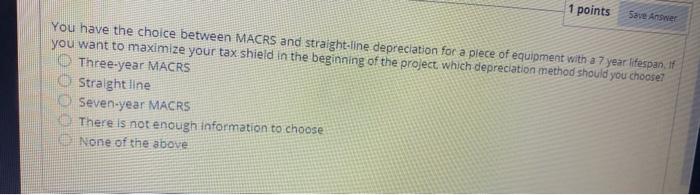

Question: please answer all 1 points Save Anne You have the choice between MACRS and straight-line depreciation for a plece of equipment with a 7 year

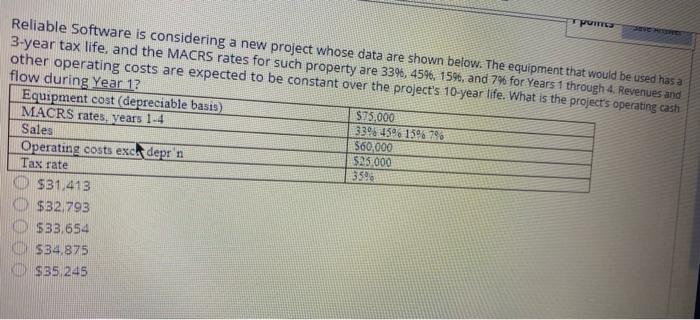

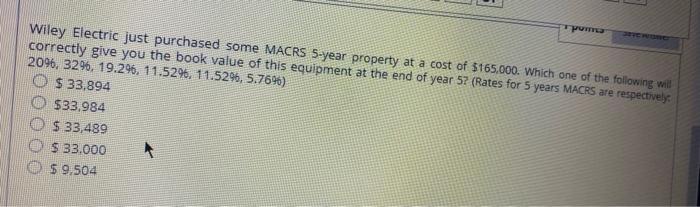

1 points Save Anne You have the choice between MACRS and straight-line depreciation for a plece of equipment with a 7 year lifespan. If you want to maximize your tax shield in the beginning of the project which depreciation method should you choose? Three-year MACRS Straight line Seven-year MACRS There is not enough information to choose None of the above PU Reliable Software is considering a new project whose data are shown below. The equipment that would be used has a 3-year tax life, and the MACRS rates for such property are 339, 45%, 1596, and 7% for Years 1 through 4 Revenues and other operating costs are expected to be constant over the project's 10-year life. What is the project's operating cash flow during Year 1? Equipment cost (depreciable basis) $75.000 MACRS rates. Years 1-4 339 45 1396 796 Sales $60,000 Operating costs exc depr 'n $25.000 Tax rate O $31,413 $32.793 $33.654 $34.875 $35 245 Wiley Electric just purchased some MACRS 5-year property at a cost of $165.000. Which one of the following wil correctly give you the book value of this equipment at the end of year 57 (Rates for 5 years MACRS are respectively 2096, 3296, 19.296. 11.5296, 11.5296, 5.769) O $ 33,894 $33.984 $ 33,489 $ 33.000 $ 9.504

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts