Question: PLEASE ANSWER ALL 10 QUESTIONS You're considering developing an industrial building and holding it as an investment for 5 years. You estimate the total development

PLEASE ANSWER ALL 10 QUESTIONS

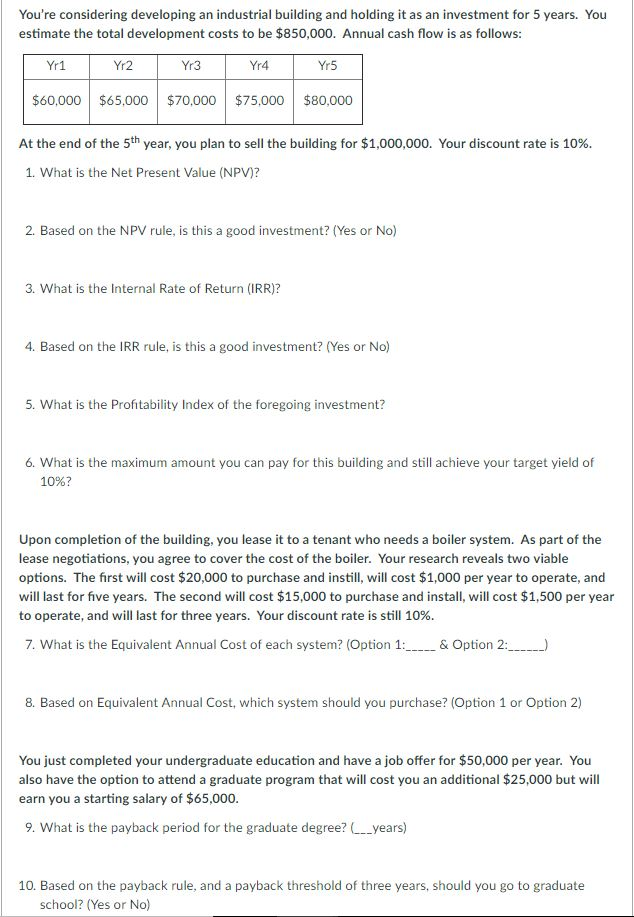

You're considering developing an industrial building and holding it as an investment for 5 years. You estimate the total development costs to be $850,000. Annual cash flow is as follows Yr1 Yr2 Yr3 Yr4 Yr5 $60,000 $65,000 $70,000 $75,000 $80,000 At the end of the 5th year, you plan to sell the building for $1,000,000. Your discount rate is 10%. 1. What is the Net Present Value (NPV)? 2. Based on the NPV rule, is this a good investment? (Yes or No) 3. What is the Internal Rate of Return (IRR)? 4. Based on the IRR rule, is this a good investment? (Yes or No) 5. What is the Profitability Index of the foregoing investment? 6. What is the maximum amount you can pay for this building and still achieve your target yield of 10%? Upon completion of the building, you lease it to a tenant who needs a boiler system. As part of the lease negotiations, you agree to cover the cost of the boiler. Your research reveals two viable options. The first will cost $20,000 to purchase and instill, will cost $1,000 per year to operate, and will last for five years. The second will cost $15,000 to purchase and install, will cost $1,500 per year to operate, and will last for three years. Your discount rate is still 10%. 7. What is the Equivalent Annual Cost of each system? (Option 1: & Option 2 8. Based on Equivalent Annual Cost, which system should you purchase? (Option 1 or Option 2) You just completed your undergraduate education and have a job offer for $50,000 per year. You also have the option to attend a graduate program that will cost you an additional $25,000 but will earn you a starting salary of $65,000 9. What is the payback period for the graduate degree? Lyears) 10. Based on the payback rule, and a payback threshold of three years, should you go to graduate school? (Yes or No)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts