Question: please answer all :) 23 A corporation which issued a bond for $1,000 with a 10 year maturity in 2012 is now facing payment of

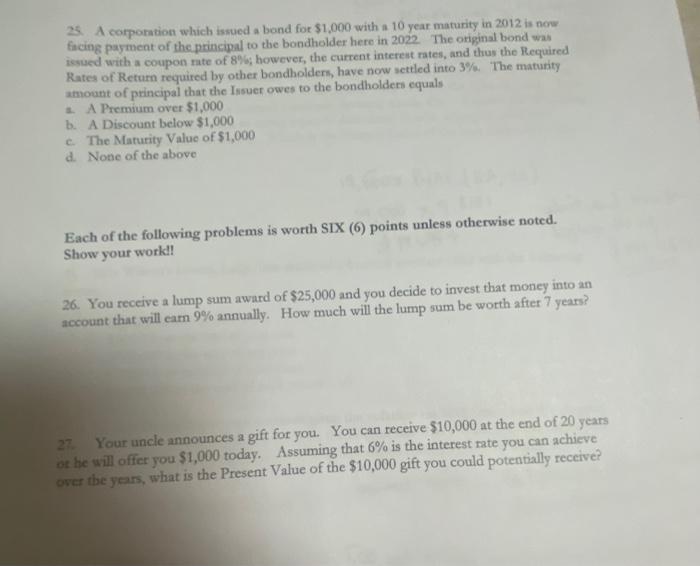

23 A corporation which issued a bond for $1,000 with a 10 year maturity in 2012 is now facing payment of the principal to the bondholder here in 2022. The original bond was issued with a coupon rate of 8%; however, the current interest rates, and thus the Required Rates of Return required by other bondholders, have now settled into 3%. The maturity amount of principal that the Issuer owes to the bondholders equals A Premium over $1,000 b. A Discount below $1,000 The Maturity Value of $1,000 d. None of the above Each of the following problems is worth SIX (6) points unless otherwise noted. Show your work!! 26. You receive a lump sum award of $25,000 and you decide to invest that money into an account that will earn 9% annually. How much will the lump sum be worth after 7 years? 27 Your uncle announces a gift for you. You can receive $10,000 at the end of 20 years ot he will offer you $1,000 today. Assuming that 6% is the interest rate you can achieve over the years, what is the Present Value of the $10,000 gift you could potentially receive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts