Question: Please answer all 3 as no asks remain! Thumbs up! Suppose a company had an initial investment of $50,000. The cash flow for the next

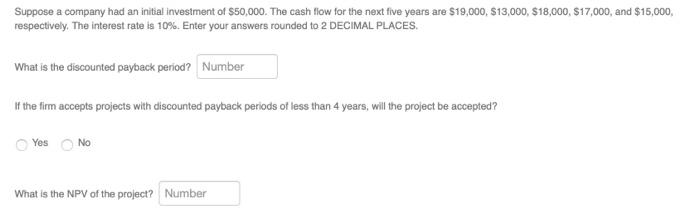

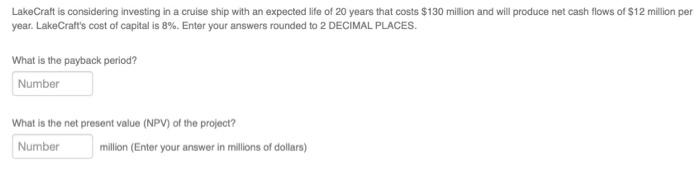

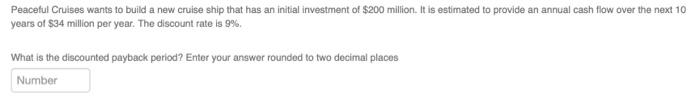

Suppose a company had an initial investment of $50,000. The cash flow for the next five years are $19,000 $13,000, $18,000 $17,000, and $15,000, respectively. The interest rate is 10%. Enter your answers rounded to 2 DECIMAL PLACES What is the discounted payback period? Number If the firm accepts projects with discounted payback periods of less than 4 years, will the project be accepted? Yes No What is the NPV of the project? Number LakeCraft is considering investing in a cruise ship with an expected life of 20 years that costs $130 million and will produce net cash flows of $12 million per year. LakeCraft's cost of capital is 8%. Enter your answers rounded to 2 DECIMAL PLACES. What is the payback period? Number What is the net present value (NPV) of the project? Number million (Enter your answer in millions of dollars) Peaceful Cruises wants to build a new cruise ship that has an initial investment of $200 million. It is estimated to provide an annual cash flow over the next 10 years of $34 million per year. The discount rate is 9% What is the discounted payback period? Enter your answer rounded to two decimal places Number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts