Question: Please answer all three as no asks remain. Thumbs up!! Suppose a company had an initial investment of $40,000. The cash flow for the next

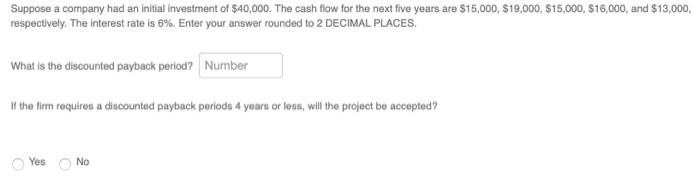

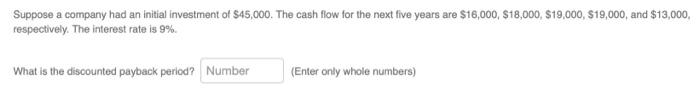

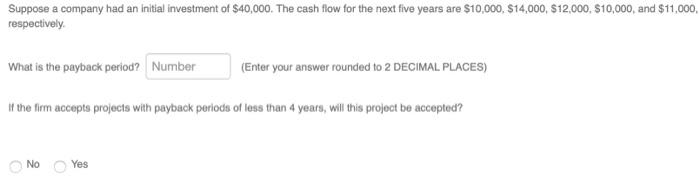

Suppose a company had an initial investment of $40,000. The cash flow for the next five years are $15,000, $19,000, $15,000, $16,000, and $13,000, respectively. The interest rate is 6%. Enter your answer rounded to 2 DECIMAL PLACES. What is the discounted payback period? Number If the firm requires a discounted payback periods 4 years or loss, will the project be accepted? Yes No Suppose a company had an initial investment of $45,000. The cash flow for the next five years are $18,000, $18,000, $19,000, $19,000, and $13,000, respectively. The interest rate is 9% What is the discounted payback period? Number (Enter only whole numbers) Suppose a company had an initial investment of $40,000. The cash flow for the next five years are $10,000, $14,000, $12,000, $10,000, and $11,000, respectively What is the payback period? Number (Enter your answer rounded to 2 DECIMAL PLACES) If the firm accepts projects with payback periods of less than 4 years, will this project be accepted? NO Yes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts