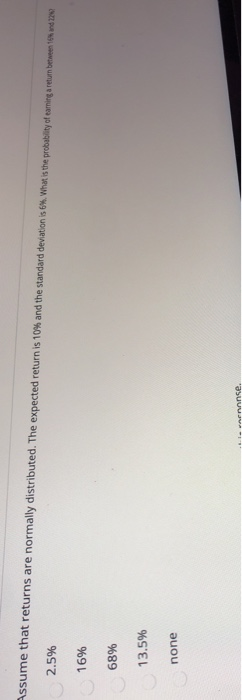

Question: please answer all 3 questions 2.5% Assume that returns are normally distributed. The expected return is 10% and the standard deviation is 6%. What is

please answer all 3 questions

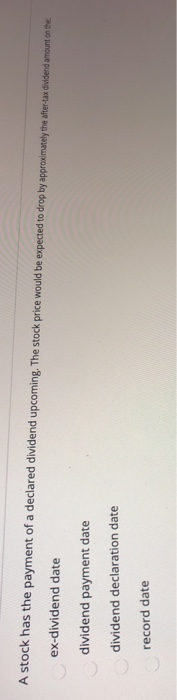

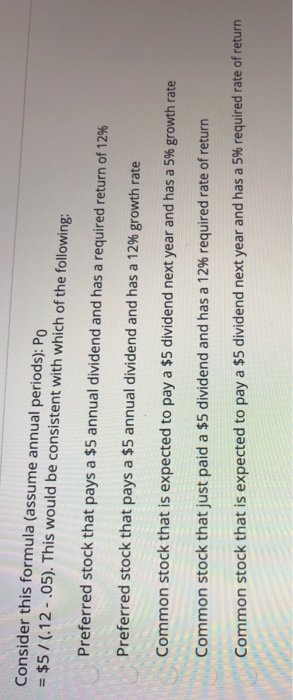

please answer all 3 questions 2.5% Assume that returns are normally distributed. The expected return is 10% and the standard deviation is 6%. What is the probability of earning a return between 12 16% 68% 13.5% none Wannse. A stock has the payment of a declared dividend upcoming. The stock price would be expected to drop by approximately the after-tax dividend amount on the ex-dividend date dividend payment date dividend declaration date record date Consider this formula (assume annual periods): PO = $5/(.12 - .05). This would be consistent with which of the following: Preferred stock that pays a $5 annual dividend and has a required return of 12% Preferred stock that pays a $5 annual dividend and has a 12% growth rate Common stock that is expected to pay a $5 dividend next year and has a 5% growth rate Common stock that just paid a $5 dividend and has a 12% required rate of return Common stock that is expected to pay a $5 dividend next year and has a 5% required rate of return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts